Collectively, the companies on the 2019 Forbes Cloud 100 have raised more than $25 billion (yes, billion with a ‘b’) in funding. It’s safe to say, then, that this group knows a thing or two about growth. So, for the third year in a row, we’re digging deep into the sales and marketing practices of the annual list to find out what’s propelling this monster success.

As in years past, we analyzed the data looking for trends around tech adoption, the use of form fields and gated content and other emerging trends including video and messaging. This year, we’re also focusing on the rise of ABM, automation and email usage.

Ready to dig in? Keep scrolling for the full report or use the links below to navigate:

- The Cloud 100

- Tech Usage, Adoption & Trends

- Lead Capture & Qualification

- 4 Key Takeaways & Predictions For 2020

- Methodology

The Cloud 100

Location

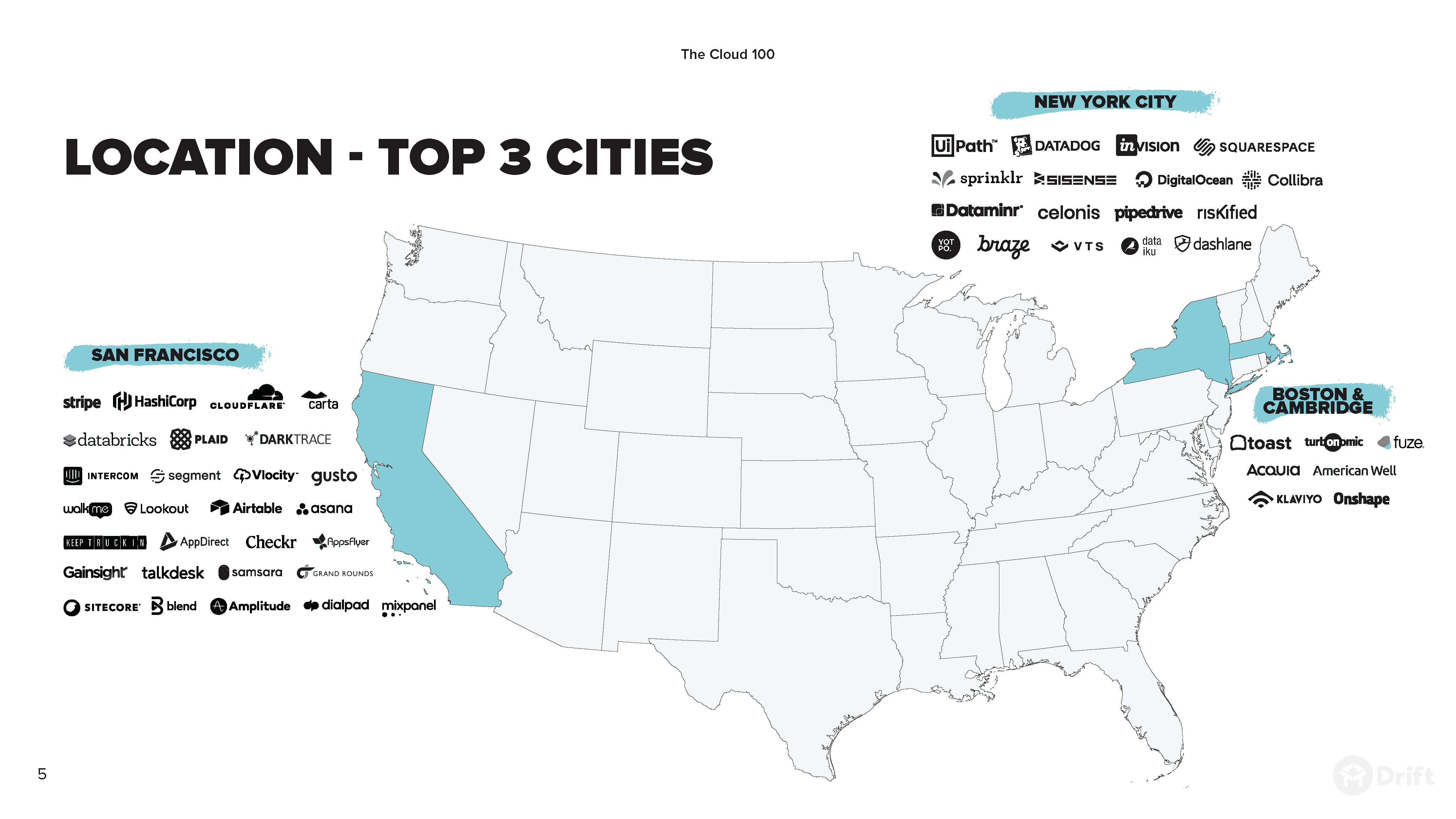

The clear winner, for the third year in a row, was San Francisco with 28 companies on the Cloud 100. This number grows significantly if you take into account the entire Bay Area. San Francisco was followed by New York (17) and Boston & Cambridge (7). Three companies are fully remote: Zapier, GitLab and Automattic, and a large portion of InVision’s workforce, 8th on the list this year, is as well.

While certainly not the norm, remote work is on the rise. And trends that we’ll touch on later, like the use of video and messaging, are making remote work more feasible than ever by removing the friction that so often comes with co-located and remote employees.

Fundraising

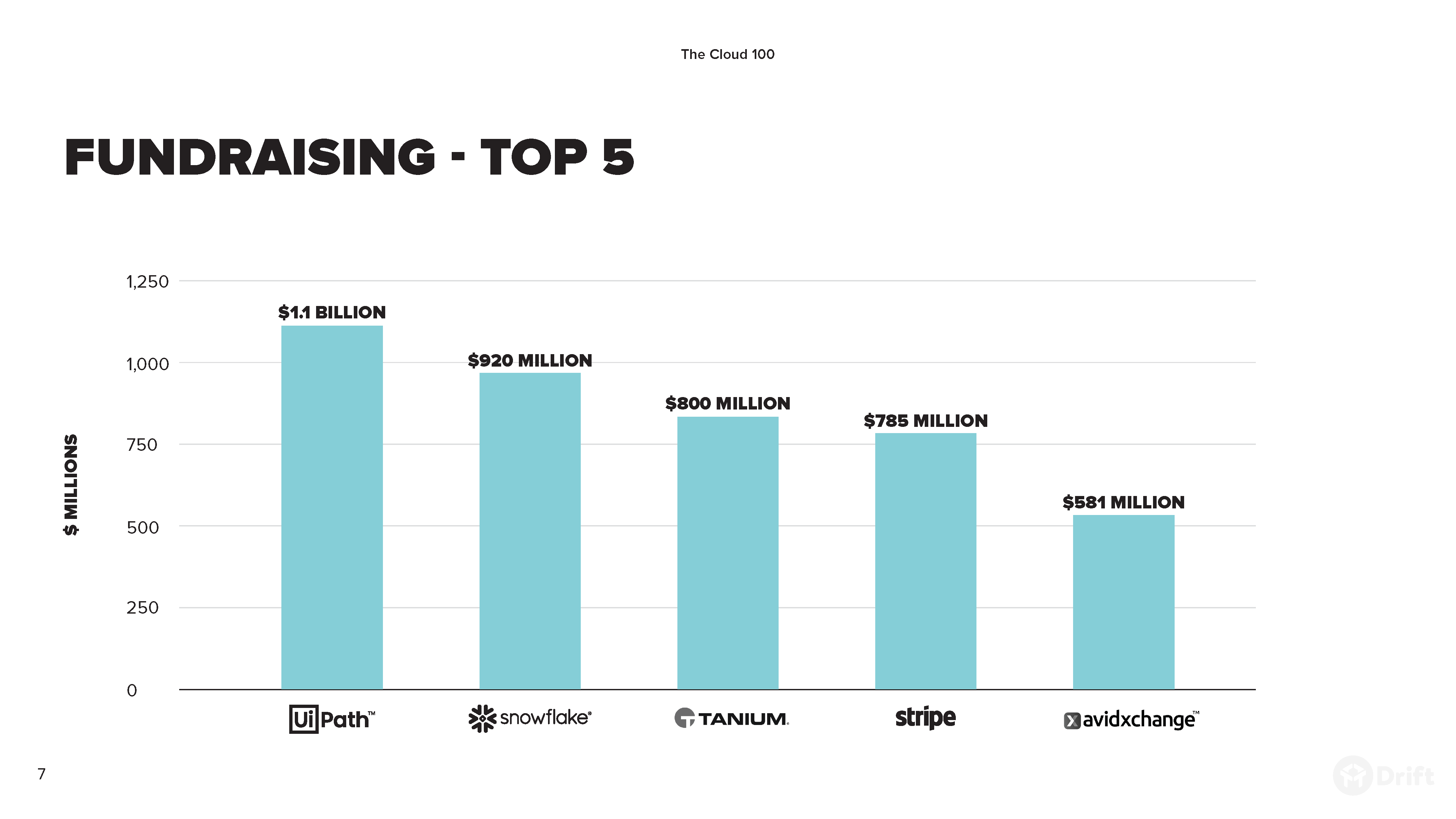

The vast majority of entries on the Cloud 100, which only includes private companies, have raised more than $100 million in funding. In fact, all but a handful have raised upwards of $60 million. Zapier raised only one round of funding – its seed round – totaling just over a million dollars. (You can read more about the company’s rise to profitability here.) And Mailchimp has bootstrapped its way to $700 million in revenue.

By contrast, the top five companies on the list, in terms of funding, have raised a collective $4.2 billion with UiPath leading the pack.

UiPath took over the number one spot having scored $586 million of fresh funding in a Series D round this past April. SurveyMonkey and Slack dropped off the list – both having since gone public. Dataminr, in 5th place last year, fell off the top five into the number 6 spot, not having raised any additional capital in 2019.

Stripe joined the top five this year, closing a $100 million Series E (2) round in January 2019. The company announced another $250 million in funding just after the release of the Cloud 100 list, bringing the payment processor’s total funding to $1 billion over 11 rounds with a valuation of $35 billion. You can read more about Stripe’s meteoric rise here.

Employee Breakdown

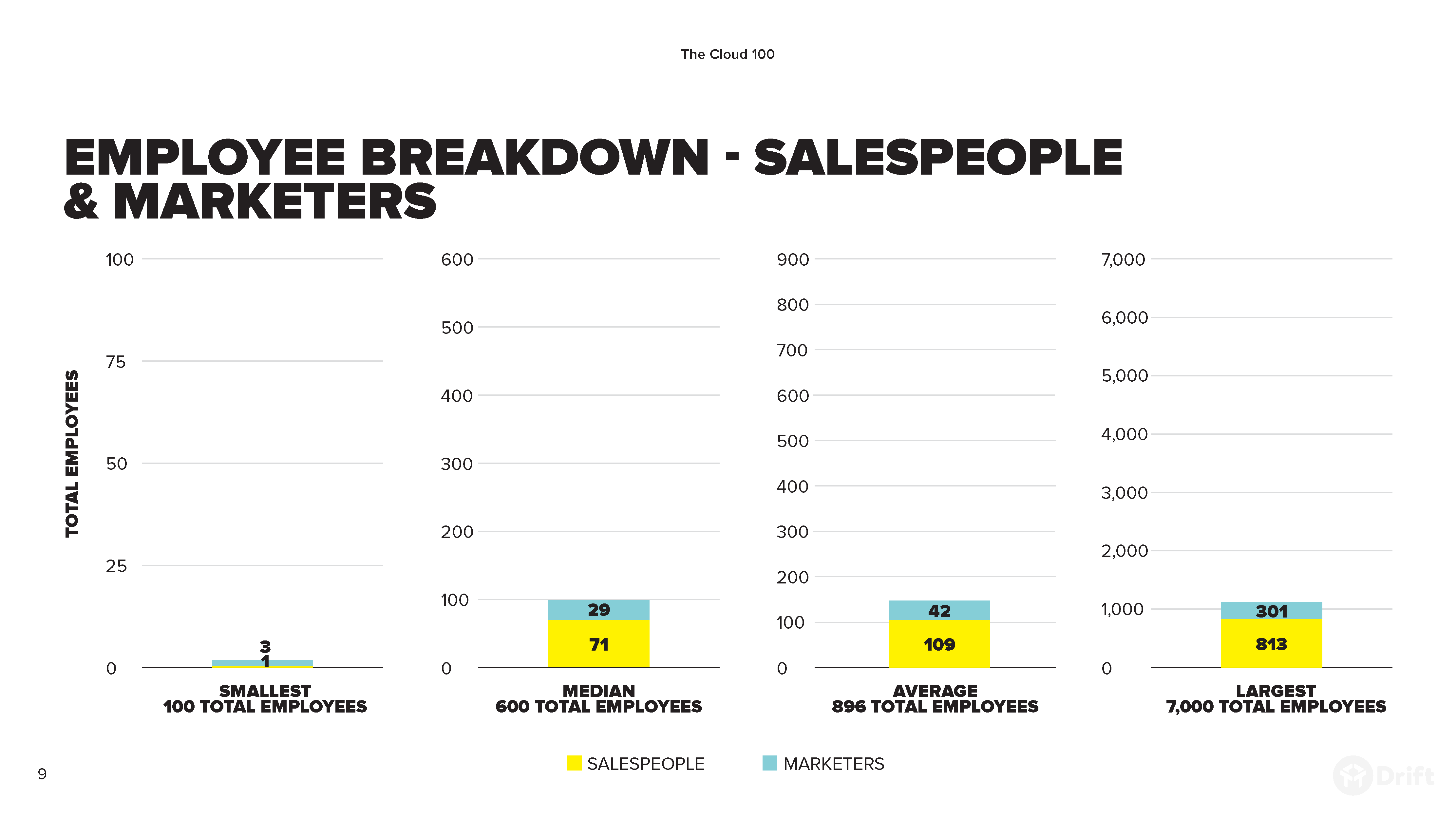

Companies in the 2019 Cloud 100 have, on average, 896 total employees, 42 of whom work in marketing (including branding, demand generation and events). And while both of these figures are up from last year, when Cloud 100 companies had an average of 706 total employees with 33 in marketing – the proportions haven’t changed. In 2018, marketers represented 4.7% of a Cloud 100 company’s workforce, which is unchanged in 2019.

But marketing is only half of the equation.

To produce the best results, marketing and sales need to play as one team. The two functions need to be more aligned than ever before to create the best possible customer experience and revenue growth prospects. One simply can’t survive without the other.

But for the third year in a row, the average size and growth of sales teams outpaced their peers in marketing.

In this report, salespeople encompass account executives, business development reps and sales development reps. We found that, on average, each Cloud 100 company employs 109 salespeople, who represent 12.2% of that company’s workforce. This is a very slight increase from 12% in 2018.

Tech Usage, Adoption & Trends

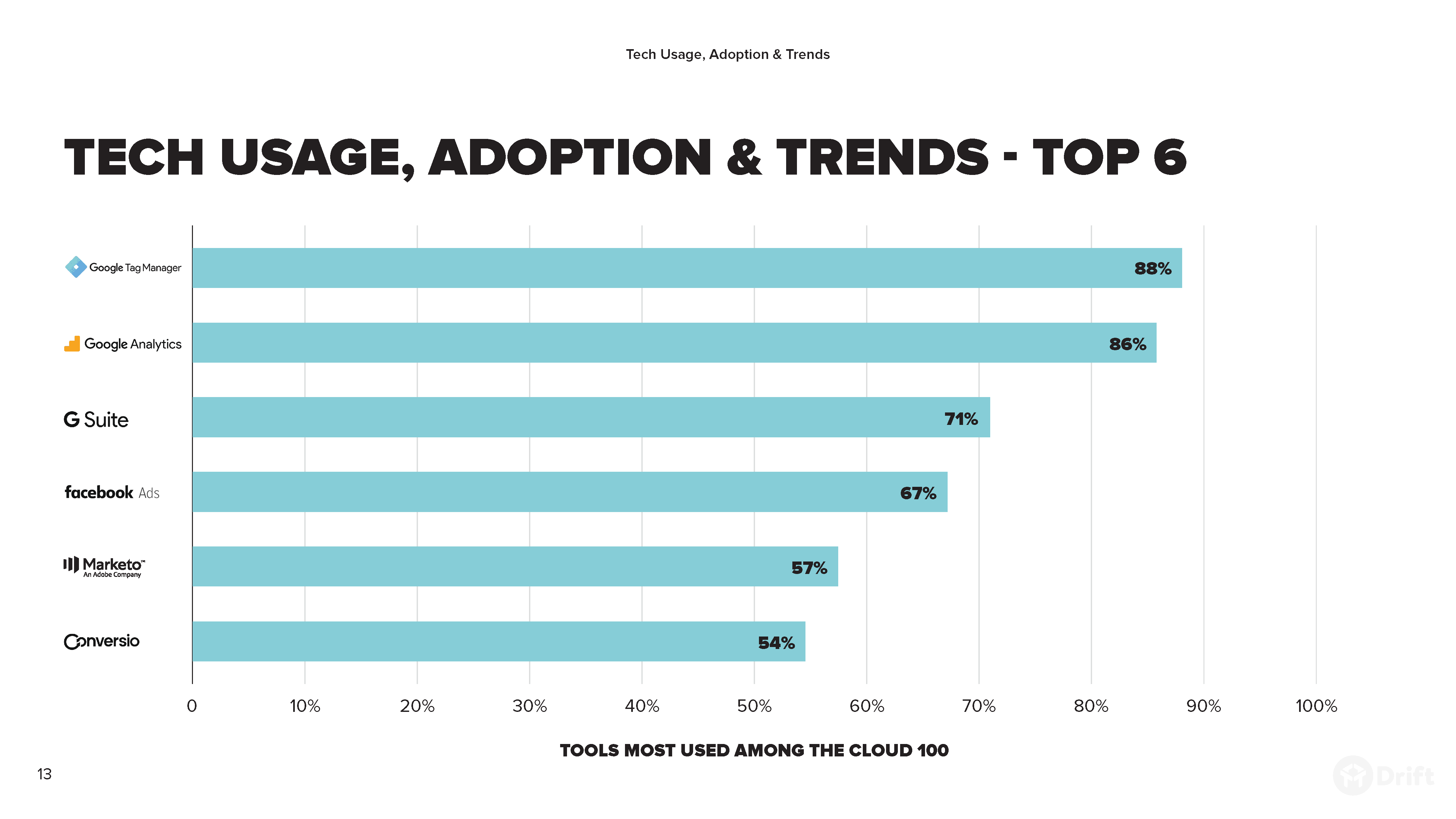

For the second year running, Google Tag Manager (used by 88% of the Cloud 100) claims the number one spot on the list as the tool most used among the Cloud 100. In fact, the second and third spots remained unchanged from 2018 with Google Analytics (86%) and Google Apps (or G Suite) (72%) holding steady.

Marketo (58%) and Facebook Advertising (67%) switched places from 2018, trading the fourth and fifth spots. Conversio, now Campaign Monitor Commerce, came out of nowhere claiming the number 6 spot (54% adoption among the Cloud 100). The tool wasn’t even among the top 25 last year.

You can view the list of all 25 top tools in the full report here.

Next, let’s breakdown key trends we can uncover based on tech usage among the Cloud 100.

Messaging

Investment in messaging tech, specifically conversational marketing, moved significantly. Drift moved up from the 23rd spot on the list (21% adoption) to number 15, with 30% adoption among the Cloud 100. Drift is the preferred Conversational Marketing software provider, with Intercom used by just 7% of the list.

Video

According to data from Demand Gen Report, 90% of marketers use video as a marketing tool. With 86% of businesses using video on their websites and 77% using video on social. So it’s no surprise then that video, as with messaging, continues to be a primary area of investment for Cloud 100 companies, though it appears more companies are investing in video hosting services that give them more control of their own content. Use of Wistia went from 22% to 31%, but use of Vimeo fell from 22% to 11%, and YouTube saw a minor decline from 29% to 28%.

For Chris Savage, co-founder and CEO of Wistia, this shift signals an investment by more companies in Brand Affinity Marketing.

“How do software companies typically drive word of mouth, decrease churn and increase expansion? They invest in and scale their products. But doing so means huge financial and human capital investments in support, sales, engineering, infrastructure and so on. Brand Affinity Marketing provides a more cost effective means of brand building. And it starts with an investment in content as a true product line.”

Recently added capabilities by Wistia to their own product make it easier than ever for brands to invest in Brand Affinity Marketing. It’s this type of functionality that’s driving more companies to platforms and tools like Wistia. And shying away from YouTube and Vimeo whose products lack the same functionality and controls for content creators.

In our analysis of last year’s Cloud 100, we pointed to video as a megatrend. Clearly, adoption is still there and climbing. According to Drift’s CEO, David Cancel, video is no longer a ‘nice-to-have’ but a necessity. “Customers want to hear your voice and see your face and have conversations with real people,” Cancel says.

Beyond video creation from a branding and content perspective, more companies are using the medium to drive sales pipeline and close more deals. Take for instance the following: According to Campaign Monitor, adding video to an email can increase click-through rates by up to 50%.

Even including the word “video” in an email subject line can increase your open rates by 19% (HighQ). Data from SalesLoft shows that 75% of late-stage prospects who received personalized videos became closed deals. And, according to Forbes, 51% of executives under the age of 40 reported making a purchase decision after watching a video.

Looking to start conversations with video? Learn more about Drift Video here.

While there’s no surprise that email and collaboration tools like G Suite and Microsoft Office were among the most used tech, we also saw continued investment in email services like Mailchimp, Mailgun and SendGrid. While these providers are tried and true stalwarts of clicks, none of them are operationalized to start the conversations that help your buyers buy. None remove the friction in the buying process.

Think about it.

With the average person receiving 125 business emails every day, martech buyers need to understand that tools designed for the traditional “spray and pray” approach to email marketing just don’t cut it anymore. They need to break through the noise by going back to the underlying goal of email: growing relationships through authentic, helpful conversations. To succeed, they need to invest in the solutions that will help them identify, follow-up with and route those conversations at scale.

Learn how to engage more leads with conversational email here.

Account-Based Marketing

There is strong adoption of ABM software among the Cloud 100. ABM providers including Demandbase, Engagio and 6Sense were featured prominently in the tech stacks of the leading SaaS companies. While none of these providers made the top 25 most used tools, 17, 15 and 10 percent, respectively, of the Cloud 100 use the providers. This points to the growing adoption of ABM tactics.

According to Demandbase’s CMO, Peter Isaacson, “In a few short years, Account-based Marketing has transitioned from a rumor, to a trend, to a must have B2B marketing technology.

During that time, ABM innovation has accelerated, with hyper-granular personalization, account identification, and intent-based targeting going mainstream in the past couple of years. ABM practitioners are now pushing the limits with more sophisticated strategies that are contributing more and more pipeline. The ABM revolution is expected to continue on this trajectory, as a recently published survey by DemandMetric reported that 89% of B2B marketers have either implemented, or are planning to implement, an ABM strategy.”

You can learn more about adopting an ABM strategy for your business here.

Automation

According to Gartner, AI augmentation will create $2.9 trillion of business value in 2021. So it’s not hard to understand why automation providers like HubSpot, Mailchimp and Marketo rank in the top 25 of the most used tech tools among the Cloud 100. But these companies deliver automation products and services that make the lives of businesses easier – valuable for sure. But they fail on two accounts. First, they require marketers to spend hours optimizing these systems, taking these people further from the customer. And second, they fail to seamlessly facilitate introductions between buyers and salespeople.

The future of automation lies in an experience that is optimized for the customer. It’s automation that’s intelligent and puts the customer first.

The next wave of Enterprise Software companies are removing friction through automation and creating a consumer-level customer experience.

– David Cancel, CEO, Drift

As we head into the next decade, automation tools need to connect buyers and sellers faster. They need to improve the lives of buyers, marketers and salespeople. Automation of the future should be about providing a human experience, no matter the time of day or day of week.

You can learn more about automation built for the customer era here.

Lead Capture & Qualification

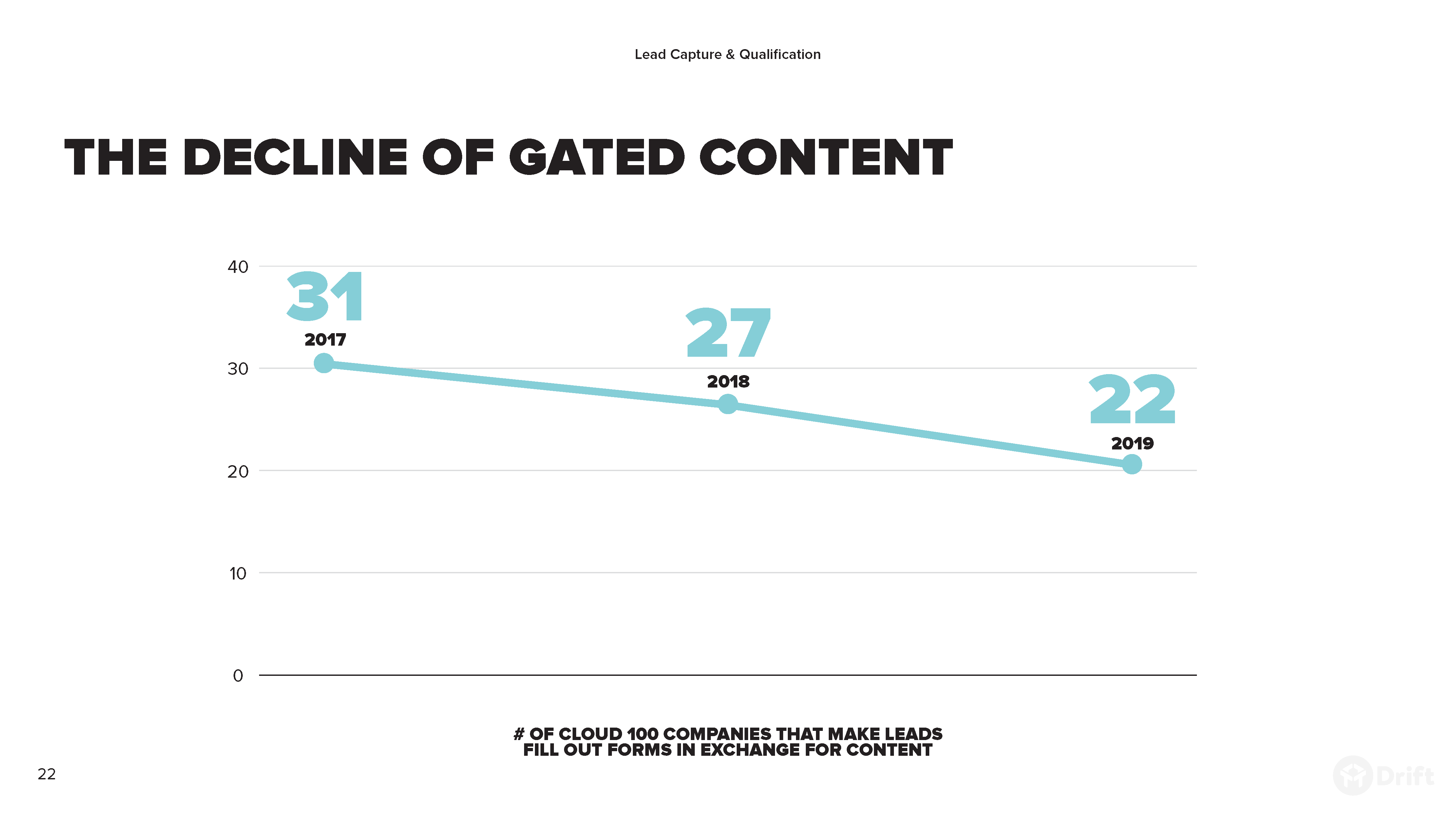

2020 marks five years of Drift. What started out as an idea – to do away with gated content – has become a reality for 50,000 organizations around the world. And as in years past, we’re continuing to see a steady decline in the use of gated content among Cloud 100 companies. Only 22 of the companies on the list rely on gated content, down from 27 in 2018 and 31 in 2017. Clearly the No Forms movement has taken hold.

Despite the move away from gated content, 90% of companies on the list utilize static ‘Contact Us’ forms in one way or another. This is up from 79% in 2018. So rather than providing a real-time means of connecting with sales or customer support, the majority of Cloud 100 companies are funneling some portion of interested buyers to a form that, by its very nature, can’t produce an immediate response.

Today’s buyers expect more. And they deserve better.

Data from our own 2019 State of Conversational Marketing report shows that failing to respond to a new lead within five minutes, results in a 10X decline in your odds of ever connecting with that lead.

Key Takeaways & Predictions For 2020

Owning the Content You Create

Companies are looking to turn customers into advocates. Wistia’s prominence among the Cloud 100 points to a growing investment in Brand Affinity Marketing and an effort on the part of leading tech companies to not only create more of their own content, but to own that content, and therefore the results.

Setting That Content Free

Speaking of content, we continue to see a decline in the use of gated content among Cloud 100 companies. While the Cloud 100 typically represent the bleeding edge, we expect gated content use to continue to decline among a broader group of companies. In its place, we’ll see more organizations adopt Conversational Marketing and other real-time means of communication in order to remove friction from the buying journey.

Getting Smarter With Email

While real-time messaging is on the rise, the use of asynchronous communication like email is here to stay. But the old way of doing email is unsustainable. Modern marketers need to rethink spray and pray email strategies and instead focus on creating conversational, authentic and personalized email nurture campaigns. Investing in email solutions that will help identify, follow-up with, and route conversations at scale will help make this a reality.

Looking Ahead To 2020: Platforms, Not Products

Collectively, the Cloud 100 uses more than 150 pieces of tech on their websites. And it’s not atypical for a single company on this list to use more than 20 pieces of technology across their website. This striation is unsustainable and we expect to see a move away from fragmented software that is loosely integrated and back to platforms in the months and years ahead. What’s more, we need to rethink how all of this software not only helps us reach our own goals as marketers and salespeople, but how it can help us create a better experience for the customer. We need to integrate and use tools with customer experience being the main priority – not our own funnels.

Methodology

Drift gathered the data for this report by analyzing the websites and LinkedIn profiles of the 2019 Cloud 100. Specifically, we leveraged the data enrichment tool, Clearbit, to uncover the tools and technology these companies use on their websites.

Our goal with this report is to provide a snapshot of how the leading SaaS companies run their sales and marketing practices. Given the nature of hypergrowth companies like those included in this report, many of the figures cited here are likely to fluctuate as these companies grow and evolve.