Pop quiz: What do Amazon, Uber, Lyft, Shopify, Peloton, Warby Parker, Squarespace, and Postmates all have in common?

Answer: They all use Stripe to process payments. In fact, there’s a good chance you’ve already made a purchase via Stripe, even if you didn’t know it. (That’s actually part of the appeal.)

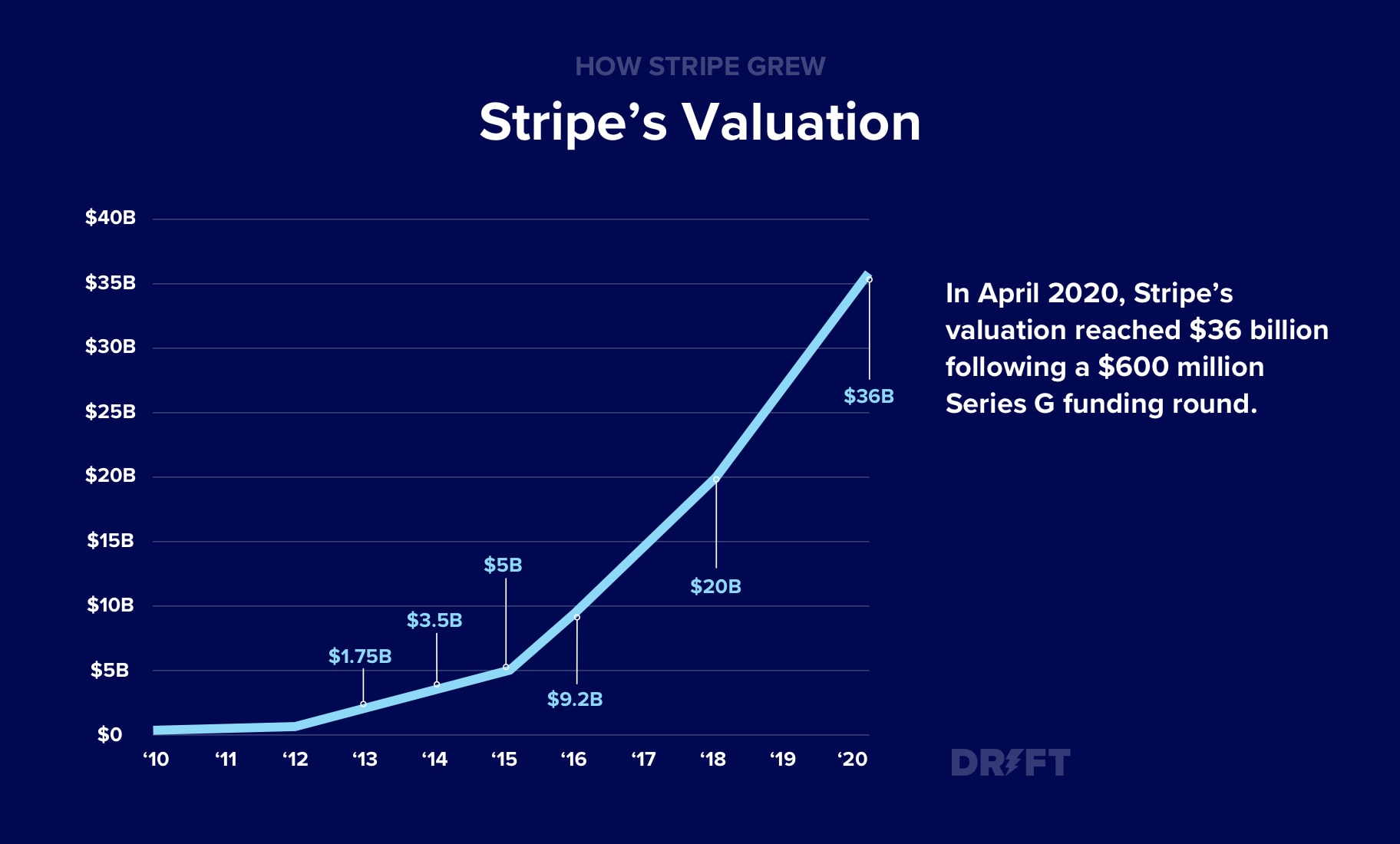

Stripe’s origin story seems to follow that classic arc of now-unicorn startups: two teen-to-twenty-somethings (brothers Patrick and John Collison) drop out of college and receive a seed investment from the startup accelerator program, Y Combinator. Their idea? In the simplest terms, to make online payments easier. In 2010, Patrick steps into the role of CEO at 21-years-old, while John becomes president at just 19. Heavyweight investors follow, and four years later Stripe’s valuation crosses into the billions.

But, what makes this story even more interesting is that Stripe wasn’t the Collison brothers’ breakout role. The two had sold their previous company, Auctomatic, for $5 million back in 2008. At the time, Patrick was 19 and John was 17.

Success for these two hasn’t been a stroke of luck: it’s been a blend of vision and business acumen – and surely, a little charisma. How else could these two turn would-be competitor PayPal into an early investor? The truth is, Stripe is likable, both for its ease of use and the brand itself. As PitchBook so wryly put it, Stripe is the “startup that nobody seems to hate.”

10 years later, Stripe continues to have an impressive track record. Just this year, the company received $600 million in an (extended) round of Series G funding, which raised the company’s valuation to $36 billion.

When you look at this incredible level of hypergrowth that Stripe has been able to achieve, it begs the obvious question:

How the heck did they do it?

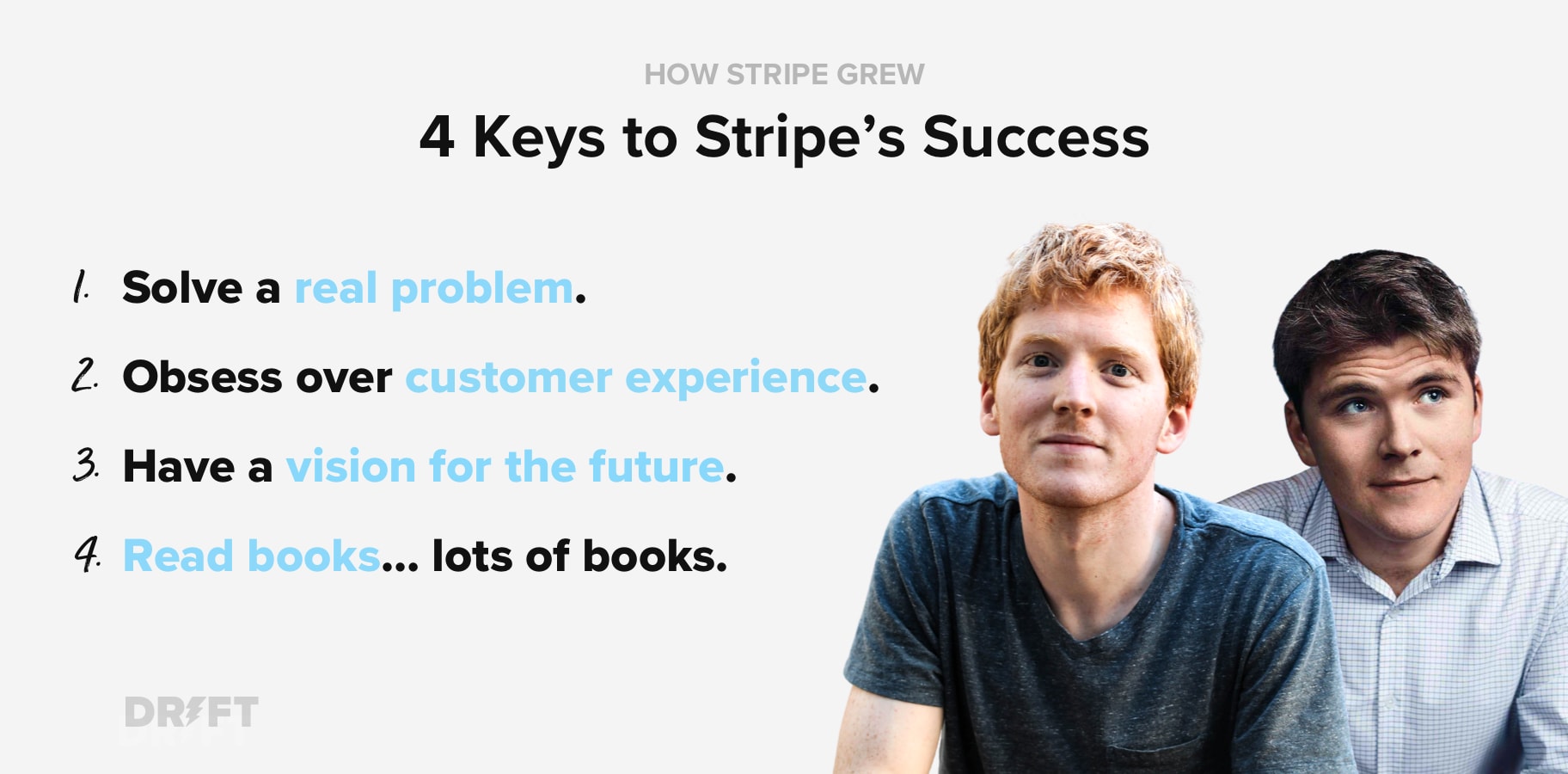

In this post, we’ll dive deep into how Stripe was able to go from $0 to $36 billion in a little less than a decade. Ultimately, there are four key lessons all companies can benefit from implementing 👇

Let’s dig in.

1) Solve a real problem.

☝️ That’s how Stripe became invaluable to its customers.

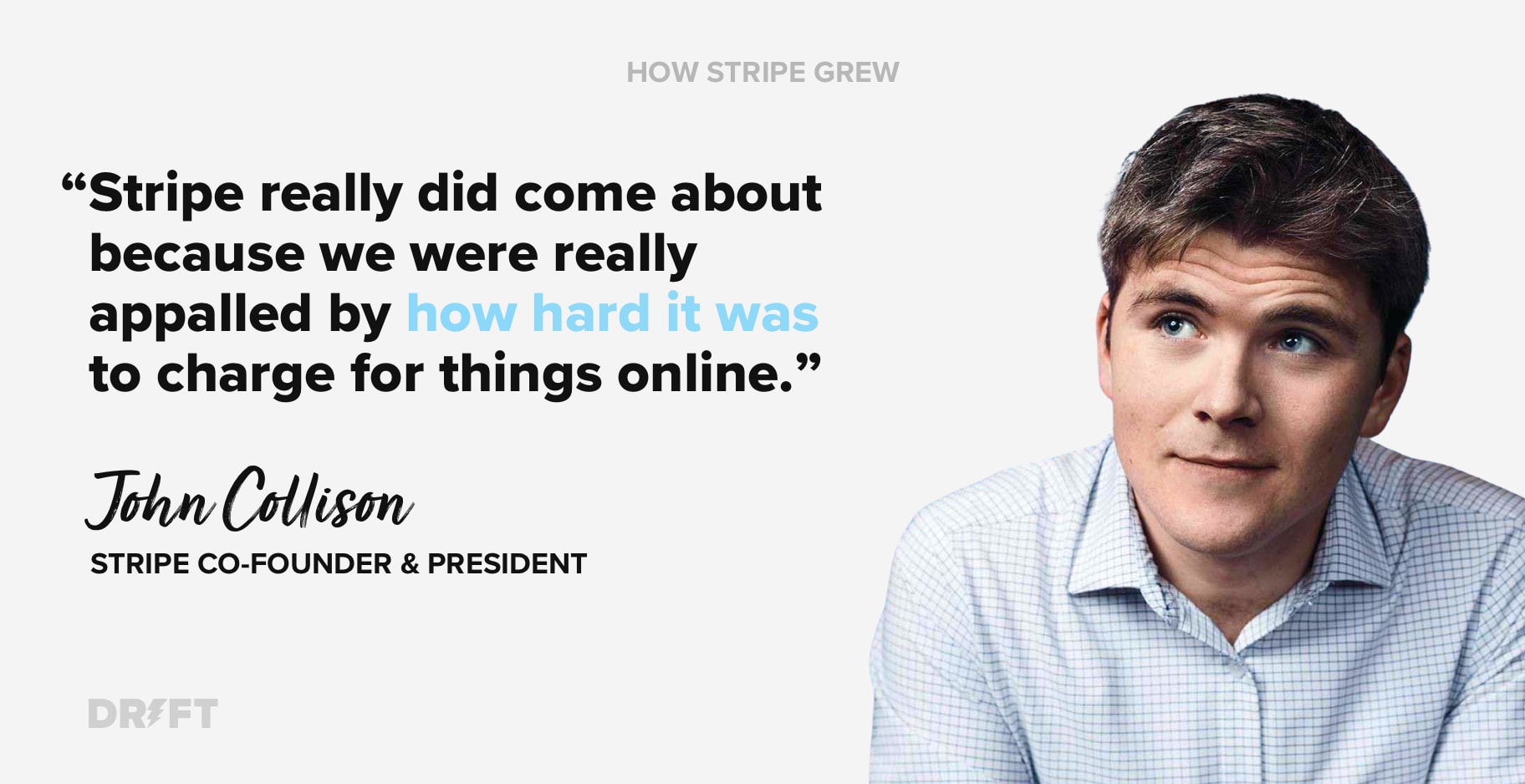

When the Collisons launched their first company, Auctomatic, back in 2007, they came to an unexpected realization. The hardest part of starting an online business wasn’t coming up with an idea, coding that idea into reality, or marketing that idea to potential customers. As John explained in an interview with Wired, “The hardest part was finding a way to accept customers’ money.”

At the time, the largest eCommerce companies invested in building their own systems for processing payments online. But for scrappy startups (like Auctomatic), this wasn’t a viable solution. It was too expensive and required weeks of back-and-forth with the bank. So instead, many of those startups turned to PayPal, which promised to make accepting online payments easier. Only…it didn’t. To the Collisons, PayPal still felt unnecessarily clunky and complex, and it came with too many regulations and setup fees. For developers who wanted to get payments up-and-running on a website quickly and easily, there was still no solution on the market. At a time when every other aspect of starting an online business had become easier, accepting payments remained complicated.

And that’s how the idea for Stripe – “a developer-focused, instant-setup payment platform that [can] scale to any size” – was born. As John told Fast Company, “Stripe really did come about because we were really appalled by how hard it was to charge for things online.”

In 2011, the year the Collisons officially launched Stripe, they visited PayPal co-founders Peter Thiel and Elon Musk and essentially said: PayPal was outdated and broken. Then, the Collisons asked for money…and got it. Recognizing the issues the Collisons saw with the current online payments infrastructure were legitimate, Thiel and Musk led Stripe’s $2 million Series A round of fundraising that same year alongside Sequoia Capital and Andreessen Horowitz.

Talk about a gutsy move. As John told Wired, “It’s a little impetuous to go to PayPal founders and say payments on the internet are totally broken. But look, you can WhatsApp anyone around the world and it’s free. It’s a remarkable act of coordination between the telcos and ISPs and the people who own the fiber underneath the sea to create this global communications network. Then, if you look at the economic infrastructure, we haven’t even started.”

The Collison brothers set out to solve a legitimate problem they faced as developers and entrepreneurs – and, as it turns out, it was a problem many of their colleagues faced as well. Developers and entrepreneurs who had been in the same accelerator program, Y Combinator, started adopting Stripe in droves.

As Patrick explained in an interview with TechZing, “Initially it very much spread through a word of mouth process. That was surprising to us because it’s a payment system not a social network so it’s not something you’d think would have any virality whatsoever. But it became clear that everything else was so bad and so painful to work with that people actually were selling this to their friends.”

Today, Stripe’s solution for online payments is all the more relevant.

Across industries, there’s been a rapid shift to online channels as the world grapples with Covid-19. In the U.S., what would have been 10 years of eCommerce growth was condensed into three months at the start of the pandemic. Stripe’s dedication to making payments, “as simple, borderless, and programmable as the rest of the internet,” has become a lifeline for businesses – especially for those that have been slow on the path to digital transformation.

In John Collison’s words, “People who never dreamt of using the internet to see the doctor or buy groceries are now doing so out of necessity. And businesses that deferred moving online or had no reason to operate online have made the leap practically overnight.”

Stripe is now solving an urgent problem for businesses – and quite successfully, we might add.

In May 2020, Patrick tweeted that businesses launched on Stripe during strict lockdown measures had already generated more than $1 billion in aggregate revenue. In August (a little less than three months later) Patrick gave an update: that aggregate revenue was about to pass $10 billion.

This number will shortly pass $10 billion. https://t.co/SLlZs5h9dS

— Patrick Collison (@patrickc) August 10, 2020

And while no one could have predicted a global pandemic, and the digital acceleration that followed, it’s clear that Stripe saw the potential (and the necessity) of building an economic infrastructure on the internet.

As Patrick noted in an interview with Inc., “I don’t think the internet’s the be-all and end-all. But I am very optimistic that the internet will be an enabler of almost every part of the economy.”

2) Obsess over customer experience.

☝️ That’s how Stripe attracted its biggest accounts, like Lyft.

Stripe has been adamant about ease of use. Its installation process is a breeze – just copy and paste seven lines of code to get up and running – and its documentation is famously clear and concise. When Stripe first launched, it felt revolutionary that developers could switch from legacy processing systems to Stripe in a single day. And along with enterprises, smaller businesses that were not digital natives could integrate Stripe just as seamlessly. (Recently, Stripe has been helping farmers adjust to selling produce online during the pandemic.)

As John explained in an interview with NPR, “We have lots of stories of people integrating payments in an afternoon or an evening and then launching their business the next day. And that just worked consistently.”

Stripe did such a good job of building goodwill around its brand early on that when it started sending out welcome packages to new customers (which included Stripe-branded stickers and t-shirts), developers actually wore those t-shirts. As Facebook product manager Morgan Brown wrote in a Growth Hackers article, the Stripe swag “only fueled the positive vibes developers had of the company. These t-shirts were worn proudly and the care packages shared on social media, mostly from developer recipients to other developers who they were connected to online.”

It’s easy to see how Stripe’s focus on customer experience increased its popularity among developers, but that’s only the half of it. In addition to reimagining the way sellers accepted payments online, Stripe also reimagined the way buyers pay for things online. Stripe isn’t just concerned about the experiences its customers have, it’s also concerned about the experiences its customers’ customers have.

I’ll let that sink in for a minute.

Unlike its predecessor, Paypal, Stripe didn’t insert itself into the buying process. It worked behind the scenes, so buyers never have to leave a company’s checkout page or enter some third-party-branded workflow to complete a transaction. When you buy something from a company via Stripe, Stripe gets out of the way and does its job in the background. This means, as a seller, you maintain a one-to-one connection with your buyer. It’s a seamless experience for everyone involved – no interruptions.

Want to learn about the considerations Stripe’s product team put into pricing, packaging, and value creation? We interviewed Tara Seshan to find out.

This dedication to customer experience is what led Stripe to win deals with major companies like Slack, Salesforce, HubSpot, and more recently, the triple-growth powerhouse, Zoom.

So, what’s Stripe’s CX secret?

Stripe is willing to learn from its customers and adapt accordingly. Take Lyft, for example. Lyft had been searching for a payment system that could both charge its customers and pay its drivers – which at the time didn’t seem to exist. But Stripe was willing to bridge that gap. As John explained to NPR, “There was no product that enabled a really good driver payment experience…And so we’ve kind of co-evolved with them to enable the best end-user experience.”

3) Have a vision for the future.

☝️ That’s how Stripe stays relevant.

The future of any company hinges on what they do next. It’s a sentiment that Patrick echoed to NPR, saying: “It would be a very dangerous mode to slip into, to become rearward-looking…You don’t have a valuable company unless the company continues to execute.”

As Packy McCormick, author of the Not Boring newsletter notes, Stripe’s initial premise of simplifying online payments has become a commodity business. What was once a trailblazing approach is now fairly standard in an increasingly crowded market – and Stripe is now competing with rivals on price, global presence, or solutions designed for specific industries.

But don’t worry about Stripe just yet – it’s not like the company has been resting on its laurels these past 10 years. As McCormick writes, “Stripe has gone from accepting payments…to providing an increasingly comprehensive suite of products that make it easy to start and run an online business.”

With Stripe Issuing, companies can instantly create virtual or physical credit cards equipped with real-time authorizations. Stripe Radar tackles another hurdle of online payments: fraud. It applies machine learning to the billions of payments processed by Stripe each year to block suspicious activity. And Stripe Atlas allows entrepreneurs, anywhere in the world, to incorporate their companies in the U.S. (specifically in Delaware, which is known for its business-friendly policies).

And these are just the highlights. Stripe has progressed beyond enabling online payments to providing payments infrastructure for the internet. As John explained to the Financial Times, “It’s easy to send a packet of information anywhere in the world, but sending money isn’t so easy. It’s a question of the economic infrastructure that’s underneath the web. We personally think that’s a really important problem – you have great connectivity at the information level but not at the payments level.”

The Collison brothers have frequently said that their goal is to “increase the GDP of the internet,” and that we’re still in the very early stages of an internet economy. Or as John put it in an interview with Invest Like the Best, “we’re really at a shockingly early point in the sigmoid growth curve.”

Which for the layperson means: there’s going to be a flip, where the bulk of economic activity will take place on the internet.

And Stripe is readying itself for that shift. The company’s recent Series G funding will be used, in part, to fuel global expansion. Currently, Stripe is available for businesses in 42 countries and can accept payments from anywhere in the world. As John Collison sees it, moving commerce online is going to be a “global equalizer.” It’s the belief that businesses shouldn’t be limited by geography.

That’s why Stripe is committed to helping entrepreneurs in every corner of the globe – especially those in the Middle East, Latin America, Africa, and Asia. As Patrick said in his launch speech for Stripe Atlas, “A majority of the growth over the next 10 years will come from underserved markets. That includes about 6.2 billion people we don’t reach yet, and that’s a huge missed opportunity.”

Stripe is continuing to remedy that. This year, Stripe announced that it acquired Paystack, a Nigeria-based startup that also focuses on simplifying payments, online or offline, via an API. (It’s been referred to as “The Stripe of Africa.”) Patrick commented on the deal – Stripe’s biggest acquisition to date – in an interview with TechCrunch, saying, “In absolute numbers, Africa may be smaller right now than other regions, but online commerce will grow about 30% every year. And even with wider global declines, online shoppers are growing twice as fast. Stripe thinks on a longer time horizon than others because we are an infrastructure company. We are thinking of what the world will look like in 2040-2050.”

Stripe’s success is linked to this visionary way of thinking. The Collison brothers are constantly considering the ripple effects of certain events, not just the immediate cause and effect. And as a result, they’re helping draw up the blueprint for an internet-enabled economy.

4) Read books…lots of books.

☝️ That’s how Stripe’s founders got an edge on the competition.

To some, reading books might seem like an odd inclusion on this list. After all, when you’re building a company, it’s hard to measure the impact reading a book can have on revenue acceleration. But for the Collison brothers, reading has been an integral part of their operation from day one.

Over the years, several prominent investors have commented on how intelligent Patrick and John are, including Mike Moritz, who referred to the brothers as some of the “sharpest” entrepreneurs he’s ever backed; and David Lee, who had this to say about Patrick:

“He’s brilliant, he’s charismatic, he’s a good leader, he’s thoughtful and poised. It’s very rare to see all that in one person.”

And while there are a variety of factors that influence a person’s intelligence, it’s fair to say that the Collison brothers – both avid readers – have benefited greatly from absorbing the ideas contained inside books.

As kids, the Collisons found school boring but were fascinated with physics and mathematics. According to Wired, Patrick would often smuggle history and science books into his classes. As he explained, “You could try to pound your head against the wall and think of original ideas…or you can cheat by reading them in books.”

Today, Patrick maintains a reading list of more than 700 books, which range in topic from economics and programming to feminism and literary criticism. But if you had to pick just one book that has had the biggest influence on the Collison brothers, as well as Stripe’s company culture, that book would be The Dream Machine by M. Mitchell Waldrop. The Dream Machine tells the story of psychologist and computer scientist J.C.R. Licklider whose visionary ideas helped make personal computing a reality. After reading the book as a kid, Patrick was eventually sad to learn that it had gone out of print. So, naturally, he bought the rights to it and started publishing it again. He also started giving all Stripe employees free copies.

So, what’s the point in encouraging your employees to read an old book? As Patrick explained to Stanford computer science students back in 2015, “So much of this early work is better than what we have today. Sure, we have solved all kinds of scaling issues, deployments, technology – but the core problems of helping people work together were thought about more back then. Their concept of technology was the empowering of humans through technology.”

But trust me: Not all of the books on Patrick’s reading list are concerned with computing or programming. Here’s a small sampling from his list:

- The Handmaid’s Tale by Margaret Atwood

- War and Peace by Leo Tolstoy

- The Feminine Mystique by Betty Friedan

- Sapiens: A Brief History of Humankind by Yuval Noah Harari

- Alexander Hamilton by Ron Chernow

At the end of the day, reading books, both nonfiction and fiction, will help expose you to a broader set of ideas and new ways of thinking. For the Collison brothers (Patrick especially) reading has helped them develop a better understanding of human nature and how they can leverage technology to better serve their customers (as well as their customers’ customers).

That’s how Stripe became Silicon Valley’s most valuable startup

When you take all of these factors into account – solving a legitimate problem, obsessing over CX, visionary thinking, and a commitment to learning – it’s much easier to understand how Stripe grew into a global company worth $36 billion. And from the Collison’s point of view, they’re still just getting started. When asked about Stripe’s status as a private company, and future plans to go public, John said:

“Stripe is not done…. We’re still heavily investing in growing the business, and if you kind of look at the stage that Stripe is at today in terms of how quickly headcount is growing and the amount we’re investing in international expansion, it still feels like a startup….Still brand new products are being created.”

Believe it or not, this hypergrowth we’ve seen in Stripe’s first 10 years may only be the beginning. Stay tuned for what’s to come.

Editor’s Note: This article was published in November 2018 and has been updated to reflect new information.