It’s the ultimate example of technology disrupting a marketplace…

Or is it really the story of a leadership shakeup that toppled an empire?

Or is it a story about the extreme hatred people have for late fees?

The Netflix vs. Blockbuster saga has been told a dozen different ways, with a dozen different lenses applied.

And what I’ve come to realize (and this likely won’t come as a huge surprise)is that there’s no single explanation for why Netflix succeeded where Blockbuster failed.

As is the case with most things in life, it was a nuanced situation. There was a perfect storm of poor decisions and technological advances and other contributing factors that led to Netflix’s staggering growth…and Blockbuster’s equally staggering decline (when Blockbuster filed for bankruptcy in 2010, Netflix’s annual net income was $161 million.)

My goal with this post is to distill everything I’ve learned about these two companies down into a few actionable takeaways for marketers – sort of like this post on Zoom’s success story.

But first, for those who aren’t familiar with how the Blockbuster vs. Netflix story unfolded, here’s a short summary:

The Rise of Netflix (and the Fall of Blockbuster)

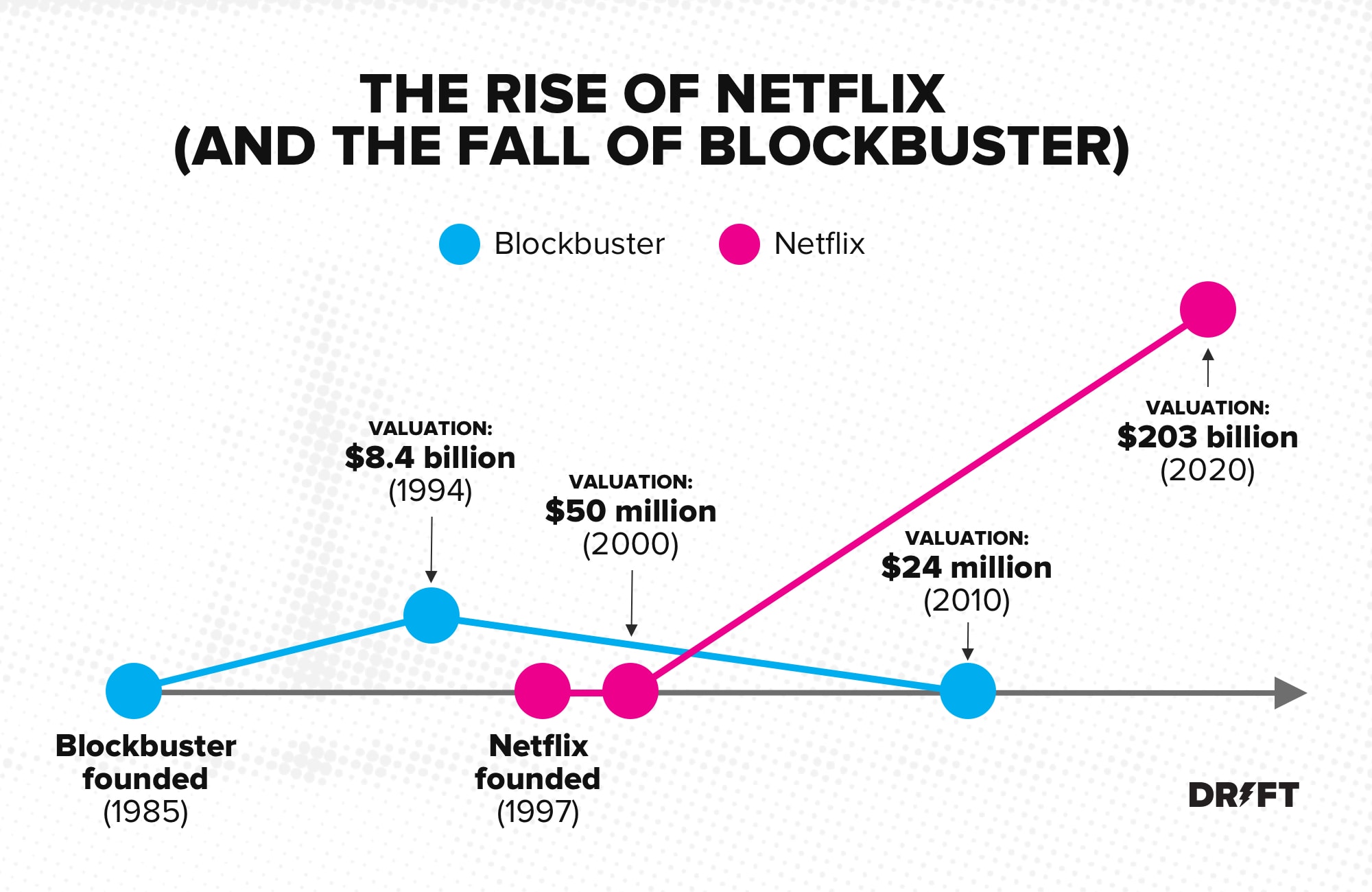

When Netflix launched in 1997, Blockbuster was the undisputed champion of the video rental industry.

Between 1985 and 1992, the brick-and-mortar rental chain grew from its first location (in Dallas, Texas) to more than 2,800 locations around the world.

Two years later, Viacom paid $8.4 billion to acquire Blockbuster.

So by the time Netflix showed up on the scene with its video rental-by-mail service, it appeared to be a classic case of David vs. Goliath.

In fact, in the year 2000 –perhaps realizing that it’d be easier to fight alongside Blockbuster than against them – Netflix co-founder and CEO Reed Hastings approached Blockbuster’s then CEO, John Antioco, with a merger proposal:

Hastings wanted $50 million for Netflix. And as part of the deal, the Netflix team would run Blockbuster’s online brand.

Of course, that deal never materialized. Partly because Blockbuster laughed in Netflix’s face when they met to discuss the deal.

“It was tiny, involuntary, and vanished almost immediately. But as soon as I saw it, I knew what was happening: John Antioco was struggling not to laugh,” Netflix’s Marc Randolph remembers of the encounter.

At the time, Antioco considered Netflix to be small potatoes, and would come to realize only too late that having an online platform would be the way of the future.

In 1999, Netflix received backing from Groupe Arnault, giving them a $30 million cash injection that helped launch its subscription-based service.

In 2004, Blockbuster did launch a Netflix-like online DVD rental platform, and even abandoned their unpopular (but lucrative) late fees for overdue rentals.

By 2006, subscribers for Blockbuster’s online services had grown to more than 2 million. (Meanwhile, in that same year, the number of Netflix subscribers reached 6.3 million.)

Then in 2007, Antioco left Blockbuster, late fees were reinstated, and Blockbuster’s online efforts were put on the back burner.

In 2008, Netflix signed a deal with Starz to stream around 1,000 blockbuster movies and shows on its service.

Blockbuster’s fate was all but sealed.

In 2010, Netflix was signing deals with names like Sony, Paramount, Lionsgate, and Disney to help them grab a 20% market share of North American viewing traffic. On July 1st of the same year, Blockbuster was de-listed from the New York Stock Exchange and filed for bankruptcy having incurred nearly $1 billion in losses.

Image Source

Netflix’s valuation at the time?

$24 million.

For comparison, today, Netflix is valued at around $203 billion – a 4,060% increase from its valuation back in 2000.

3 Takeaways from the Netflix vs. Blockbuster Battle

1. Never forget what you’re really selling.

For years, Blockbuster dominated the video rental space. But at some point, they lost sight of what business they were really in.

Instead of focusing on delivering incredible (and affordable) entertainment to their customers – something Netflix definitely has down – Blockbuster put more stock in the model they were comfortable using.

And hey, who can blame them? Back before the internet became integrated into nearly every facet of our lives, it was hard to imagine brick-and-mortar Blockbuster stores disappearing.

Blockbuster initially succeeded because they did one core job better than anyone else: delivering entertainment to people’s homes.

But as we all know, technologies change. And instead of investing all of their efforts into finding a new way to deliver on their true purpose (more on that in the next section), Blockbuster’s innovation stagnated. That reality hit Netflix founder Marc Randolph when the business was pivoting from a Mail-order DVD service to online streaming.

He wrote in his book, That Will Never Work: The Birth of Netflix and the Amazing Life of an Idea:

“We’d finally figured out a way to make our original idea of DVDs by mail work, and here we were, looking ahead to a future without either DVDs or mail.”

The way Netflix overcame its challenges? Keep reading 👇

2. You need to be willing to adapt. (And half measures won’t cut it.)

1997 era Netflix–before the company embraced streaming

When you dig into the Netflix vs. Blockbuster story, it becomes clear that Blockbuster did (eventually) realize that the Netflix model was the future. And they did make changes to address it.

But in the end, it was too little, too late.

Blockbuster could never fully evolve into the modern business it needed to be in order to compete with Netflix. Once owning 9,000 stores in the US, Blockbuster now has a single brick-and-mortar presence – a lone store in Bend, Oregon.

Sandi Harding, the owner of the single remaining Blockbuster store in the world. Source.

As Forbes reported:

“The irony is that Blockbuster failed because its leadership had built a well-oiled operational machine. It was a very tight network that could execute with extreme efficiency, but poorly suited to let in new information.”

Technologies improve. Industries change. In order to grow, you need to keep a pulse on the ever-evolving needs and preferences of your customers so you can make changes to your model accordingly.

London-based Video Producer Andy Ash says this was Blockbuster’s downfall. The company was too busy making money in their video stores to imagine a time when people would no longer want or need them.

“In a bid to rescue their business, their answer at the time was to fight fire with fire. At one point they even opened up rental kiosks, a little bit like a vending machine, but all of these attempts were based on either outdated technology or outdated business models, whereas Netflix at the time, they did the opposite; they streamlined, they were able to see the future of video rentals and then innovate for that future.”

This applies to products and services as well as to marketing strategies. Believe it or not, marketing channels have a shelf life.

So even if you learn how to dominate a specific channel, you need to remember that all channels, no matter how popular they are today, could someday fade into oblivion…just like brick-and-mortar Blockbuster locations did.

The key to surviving, and thriving?

Embrace change.

Blockbuster didn’t. Even in 2008, the company’s CEO, Jim Keyes, was perplexed by (or refused to accept) Netflix’s appeal to customers:

“I’ve been frankly confused by this fascination that everybody has with Netflix…Netflix doesn’t really have or do anything that we can’t or don’t already do ourselves.”

As Square2Marketing’s Mike Lieberman explains:

“Blockbuster didn’t believe a month-to-month subscription service would ever actually work. And it certainly wasn’t planning on going digital. Even when the company was offered a buyout deal early on, it declined, believing that its previous business revenue model would work just as well in the new wave of movie watching as it had in the past.”

3. The customer-driven approach always wins.

Customer-Driven Sales & Marketing from Drift

As we’ve already established, there were several factors that contributed to the company’s downfall, including not understanding what business they were really in – entertainment, not retail – and not being flexible enough to adapt.

But another key piece of the puzzle was Blockbuster’s unwillingness to put their customers first. The company’s revenue relied (massively) on charging late fees. As David Reiss explains:

“Blockbuster’s profit had to be sufficient to sustain their worldwide stores and staffing levels. As well as their pricing structure reflecting this, their profit also relied on something their customers hated – late fees.

A significant portion of the revenue that Blockbuster needed to stay in business was a revenue stream that Netflix didn’t even charge for, as you could keep their movies as long as you wanted.

Whereas Netflix developed a business model that simplified the video-renting process, making it more enjoyable for customers, Blockbuster only thought about maximizing their own returns.”

Forbes described Blockbuster’s reliance on penalizing its patrons in the form of a late fee as the company’s “Achilles heel.” When Blockbuster did finally address the issue, the cost of dropping late fees from their model amounted to a loss of $200 million.

“Any time you can get rid of the No. 1 customer dissatisfaction factor and in the process generate higher customer traffic, for me, as a retailer, that spells a good answer,” CEO John Antioco said of the move at the time.

Narrator: it didn’t work.

At the same time, the company cut its late-fee revenue stream, it was building out its online platform cost another $200 million. If you add up these two costs, Blockbuster paid $400 million in an effort to modernize and remain competitive with Netflix.

We’ll never know if this plan would have succeeded. Shortly after this modernization effort, Antioco was ousted by the board after the changes were made.

Blockbuster then returned to their company-driven ways…and went bankrupt a few years later.

Final Thought: Change Is Inevitable

When I was a kid, getting to pick my own movie at Blockbuster was a rite of passage.

Every weekend, my siblings and I would pile into my dad’s car and make two stops. First, we marched into Blockbuster. Then it was over to the supermarket next door for snacks, soda, and frozen pizza. It was our little ritual.

But these days, the idea of going to a brick-and-mortar store to rent a video seems kind of crazy.

With the rise of Netflix, home entertainment became just a few clicks away. It’s become its own kind of ritual – for over 182 million paying members.

So the next time you think to yourself, “The way we do things now will never change,” remember the Netflix vs. Blockbuster saga and how an entire industry can become upended in just a few years.

Editor’s Note: This article was published in July 2017 and has been updated to reflect new information.