Chief revenue officers (CROs) offer even more revenue-driving potential than you might already imagine based on their title. Not only does their work focus on directly growing revenue through their own team’s actions, but they also orchestrate different departments around common objectives.

While individual departments might track their own unique sets of metrics, CROs are in charge of overseeing metrics that impact the company as a whole.

Whether you are a CRO or want to better collaborate with your CRO, deepening your understanding of the responsibilities of this role and the owned metrics can take you a long way towards growing that one thing all businesses need more of: revenue 💰

What Is a Chief Revenue Officer?

A chief revenue officer drives profitability and guides revenue-driving teams towards higher performance, shorter deal cycles, smarter scaling initiatives, improved customer retention, more stable pipeline, and other revenue-generating processes.

Depending on the industry and organization size, CROs can act more as sales leaders and do hands-on work with prospecting and deal closing – or they might only review and guide those actions of the sales team, focusing more of their engagement on conversations with customers.

Regardless of the individual differences in the role by company, all chief revenue officers are in charge of monitoring various revenue streams and analyzing what works, what doesn’t, and what needs to change.

It’s always a role with a long list of responsibilities.

What Goals and Responsibilities Do Chief Revenue Officers Own?

While the responsibilities differ, they are categorizable into a few key areas:

- Revenue analysis – Revenue is in the title and is of primary importance to the CRO. CROs are in-tune with their organization’s high-level revenue, pipeline, and funnel metrics, always with an eye on how these can be improved.

- Inter-departmental collaboration – The CRO often has the sales department in their organization, but has a scope beyond just one department. They serve as a critical inter-departmental bridge between sales, marketing, product, customer success, and finance to drive revenue initiatives.

- Customer retention activities – In some organizations, chief revenue officers will analyze and strategize how to improve retention via the customer success In other organizations, they will speak directly with customers in order to renew their contracts. CROs are focused on their ultimate goal: revenue, which requires both new acquisition as well as ensuring customers stay customers.

- New booking initiatives – Chief revenue officers are always focused on new booking initiatives and the go-to-market strategies on how to best execute. Some leading indicators for new bookings that interest CROs include pipeline development, meeting conversion rates, and sales cycles.

What Are the Top Traits and Skills of a Chief Revenue Officer?

What does it take to be an amazing chief revenue officer?

One word: strategy.

A chief revenue officer isn’t focused on making quick sales and closing key accounts, but on strategically approaching a market and maximizing the revenue potential of that market.

This requires not only placing the right bets, but placing them in the right order – because you can’t maximize every potential revenue stream all at once. A CRO will partner with other leaders in the organization to call the shots in going after the right geographical market, choosing the next customer satisfaction campaign, or identifying the most successful partner segments.

There’s a ton of strategy involved in this role and it incorporates all of the following plus plenty more:

- What existing resources can execute on well

- What new resources are required

- Best customer segments

- Best revenue streams to add

- Customer retention improvements to make

- Additional target customers

- New markets to enter

- How to best engage partners and alliances

Companies are increasingly focused on selling solutions and “outcomes”– often comprised of complex bundles of products and services via multiple sales models and channels – all of which need to be managed holistically. Chief Revenue Officers set the vision and constantly tweak all the levers a company has, to generate revenue based on fresh data.

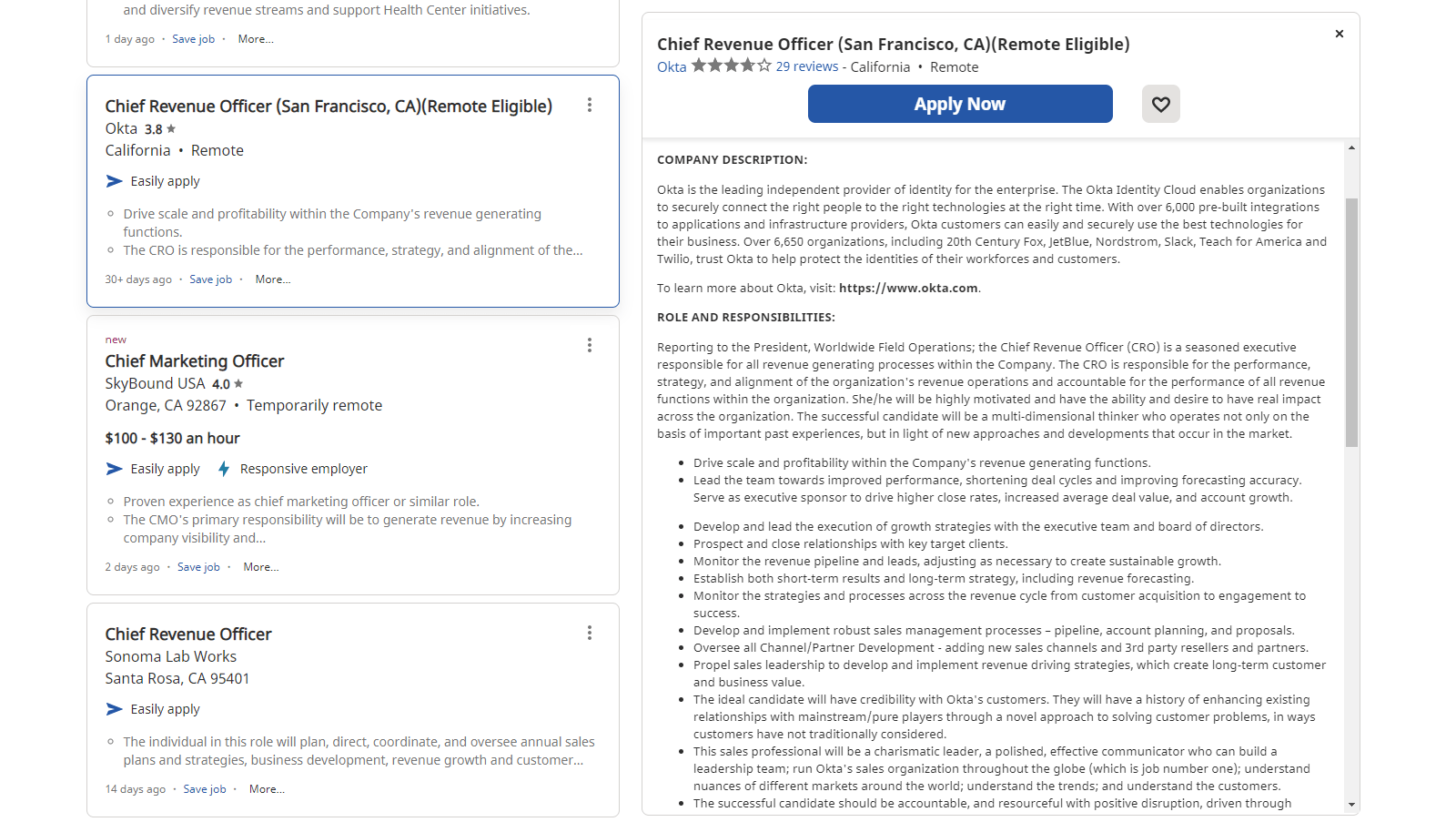

Why Are More Companies Hiring Chief Revenue Officers?

So why are more and more companies hiring chief revenue officers? The reason is that they aren’t focused solely on sales, and CEOs see the value of that.

More CEOs are coming to realize that they need someone to help guide strategic decisions before leaders jump in and spring into revenue-affecting actions without coordination.

The bottom line is that companies see that it’s not just sales that wins the day. We need to think more holistically and systematically beyond the sale, to the entire market landscape, customer relationship, overall market potential, and strategic scaling timelines.

The CRO earned a seat at the c-suite table because revenue growth needs oversight. It needs constant maintenance and tweaking. And it needs someone at the helm removing silos and identifying the strategic levers to pull that will grow a company’s revenue.

Chief Revenue Officers & Collaboration

Chief revenue officers put the customer at the center of absolutely everything they do, and that’s the most valuable thing they bring to the table with their leadership role.

They act as an ignitor of customer-centric thinking in whatever team or department they collaborate with.

Which Teams and Roles They Work Closest with

Chief revenue officers touch nearly every aspect of the company:

- Sales

- Customer success

- Product

- Marketing

- Finance

- Customer service

In all interactions, they’re looking at which levers can be pulled to improve scalability. For example, when interfacing with the product team, they might help strategize how certain offers can be packaged up to drive more revenue and success for customers.

When working with customer success and customer service, they’ll be suggesting ways to serve customers at a deeper level so that customers can really measure the ROI of what they’re paying for.

At the same time, they might collaborate with the CFO and finance team to nail down targets for customer acquisition costs, so that profitability takes center stage, not just revenue.

Analysts now say that six years of digital transformation is happening in one. In addition, companies looking to remove silos across their teams are dealing with a more distributed workforce and customer base. If there was ever a moment for your company – and revenue teams – to come together, it’s now.

How to Get Multiple Teams Working Towards Common Revenue Goals

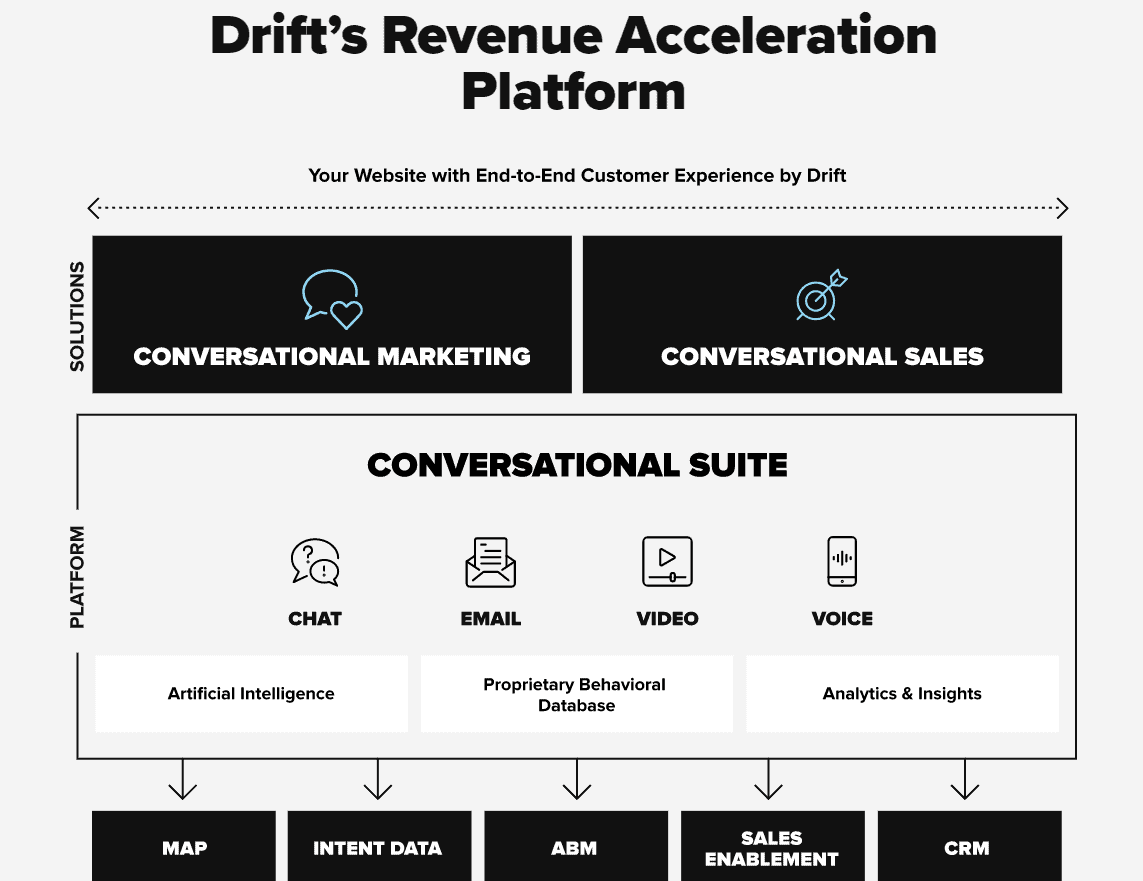

At Drift, we stopped talking about sales and marketing as separate teams and started focusing on Revenue Acceleration because we wanted everyone to have a common language and set of objectives.

We spent some time earlier talking about how the CRO drives interdepartmental collaboration. One of the best ways to do this is to orchestrate those departments’ goals and metrics.

A CRO can help teams track the right, holistic metrics to see the impact of their work – and most importantly, keep tied to the strategic goals of the organization.

By celebrating our revenue, we were merely celebrating our marketing efforts and not the quality of our service. We should have been paying attention to the metrics that showed the quality of our service. In our case, those metrics were retention, churn, and customer success. When you look at the numbers, we were heavily reliant on our marketing engine. We were good at marketing a product, but not very good at delivering.

The Metrics Chief Revenue Officers Care About

Drift’s focus on Revenue Acceleration is all about asking this question: how can sales, marketing, and customer teams drive revenue together?

CROs are not looking at the in-the-weeds metrics that matter to individual teams – such as meeting conversion rate or homepage conversion rate. Instead, they are looking at big-picture metrics. If these aren’t up to par, then they need to know how to dive into the supporting metrics and pull the right levers.

Metric #1: Revenue

We have to list revenue first because a chief revenue officer’s entire day revolves around revenue.

However, how the key supporting metrics for revenue will depend largely on the industry. For example, in the SaaS world, annual recurring revenue (ARR) is a major headline metric, while in telecommunications, average revenue per user (ARPU) is often used.

Depending on what you sell, your CRO will have their own ideal metric or metrics that help them measure the effectiveness of their strategies.

What supports this metric

Going deeper, your CRO will also measure where your revenue is coming from (existing customers versus new customers, segment A versus segment B, etc.). There should be different revenue targets for customer segments based on where they are in their journey, and if these aren’t being met, that can tell you a lot about the effectiveness of your strategy with certain types of accounts and companies.

The metrics that support revenue growth and measurement will depend a lot on your strategy. For example, if your company is currently engaged in geographical market expansion, then your CRO will be paying heavy attention to the percentage of revenue coming from international markets.

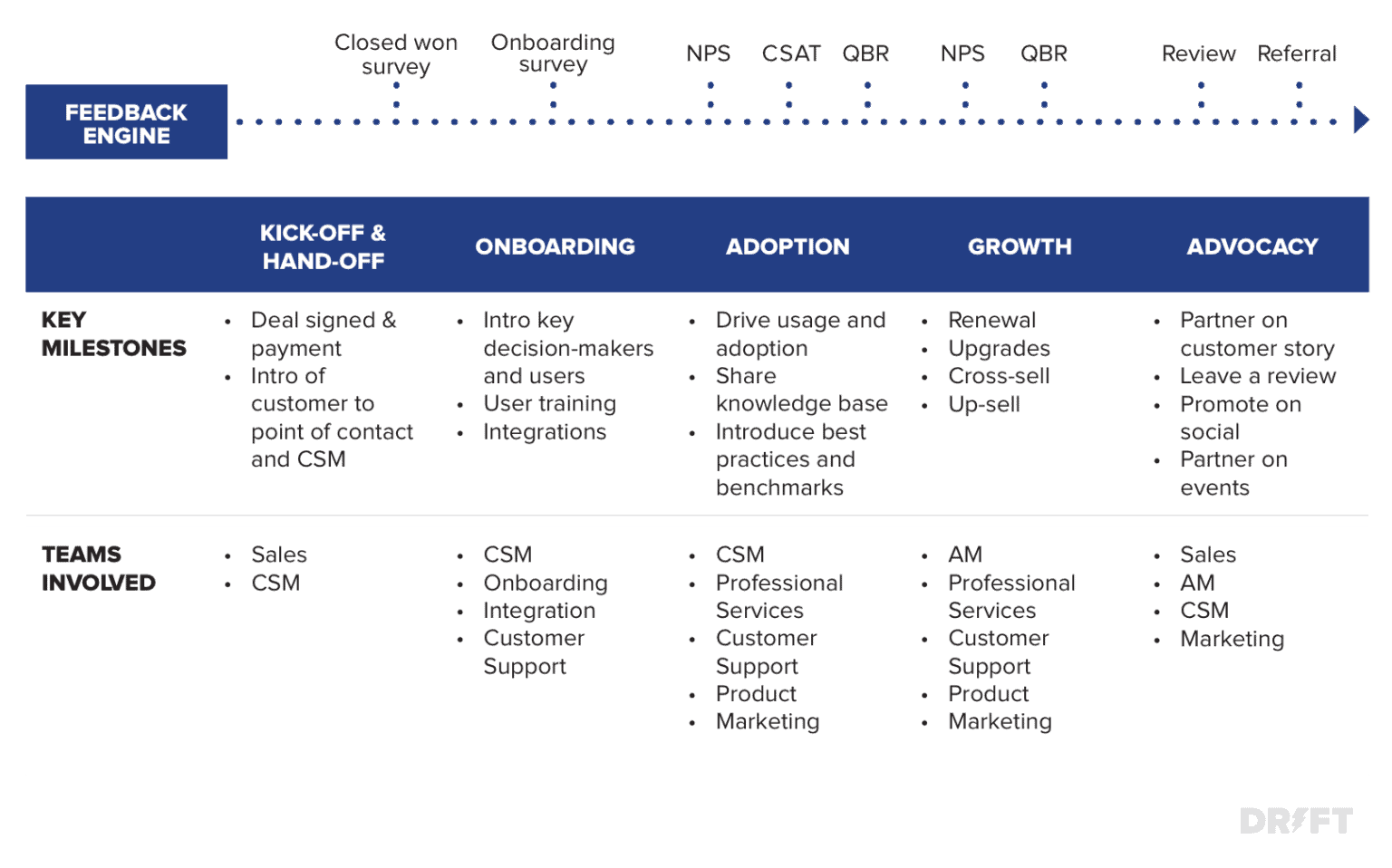

Metric #2: Retention

For SaaS companies, retention is often the number two metric a CRO prioritizes, whereas other industries might review repeat business or wallet share.

When it comes to retention there are two key things your company should be measuring: gross and net. Gross retention revenue measures against the contracts that are expected to renew, while net retention includes renewals plus expansions.

Both of those metrics are extremely important for understanding the health of your customer base, your customer satisfaction level, and the extent to which your customers expand their business with you.

What supports this metric

Poor retention rates are a lagging indicator that your customer base is not satisfied with your products and services. You’ll want to look at NPS and data from the customer success and customer service teams to understand what levers you can pull to fix retention.

It’s important to keep track of your leading indicators so you’re not shocked by poor retention rates. This is why many CROs will closely watch customer satisfaction scores. They’ll also be looking for ways to increase customer lifetime value.

Metric #3: Pipeline

Pipeline is a critical metric that nearly all B2B companies measure and analyze, regardless of what they sell. When you’re looking at pipeline, you’re really focusing on future revenue potential, because pipeline is just one step away from revenue.

The ultimate question is this: do we have enough pipeline to generate the revenue results that we’re looking for? If not, it’s time to jump deeper into the pipeline funnel to find out where we can make changes.

What supports this metric

There are so many micro-metrics and details that affect pipeline:

- Where is the pipeline coming from?

- How is the team building that pipeline week over week?

- What is our meeting conversion rate?

- What is our show-up rate?

- Is our pipeline being filled with our most profitable audience segments?

Because pipeline is the next step before revenue, there are endless motivations to explore expanding it, and plenty of opportunities.

Here’s an example of the funnel Drift’s SDR team uses to ensure its pacing is on target with pipeline goals.

Metric #4: Average Selling Price

Your average selling price is a critical revenue-affecting metric. Your CRO will want to keep an eye on your average selling price or average deal size in order to spot potential improvements.

For example, an ASP that’s not on target could signal the need for improved sales team training, more controls over discounting, or for adding a higher percentage of prospects at the top of the funnel who are more likely to purchase add ons, more user accounts, or other services that increase deal size.

If your company is selling to existing customers, you might set a different target for average deal size for expansion, and keep your ASP metric for new customers separate.

What supports this metric

To positively impact ASP, you can dive into metrics for individual sales of subscriptions, products, or services. Is the custom integration or API work not selling as well as it should? Are you needing to discount more because of competitive pressures? If you are tracking total contract value, are not enough customers choosing a three-year contract, and opting for a one-year contract instead?

Look into all of the factors that contribute to your ASP and see which ones have the most potential. Then, work with your sales team to better identify new and existing customers that are a fit for these products or services.

You’ll likely want to revamp your sales messaging using customer research as well. You may find that one buyer persona is being too quiet about their needs and that advocating for them could increase your ASP while upping customer results at the same time.

Metric #5: Sales Cycle Time

The sales cycle time refers to the amount of time between initially communicating with a contact, all the way up until the deal is closed. Of course, your sales cycle time can have a huge impact on revenue, pipeline needs, and new sales rep ramp time.

Three-quarters (74.6%) of B2B sales to new customers take at least 4 months to close, with almost half (46.4%) taking 7 months or more.

What supports this metric

There are so many factors that contribute to a healthy sales cycle length, and some of them are out of your control. Certain industries and audience segments are simply slow movers.

But there’s plenty your team can analyze and affect. Sales enablement, nurturing, follow-ups, and omnipresence are all big movers.

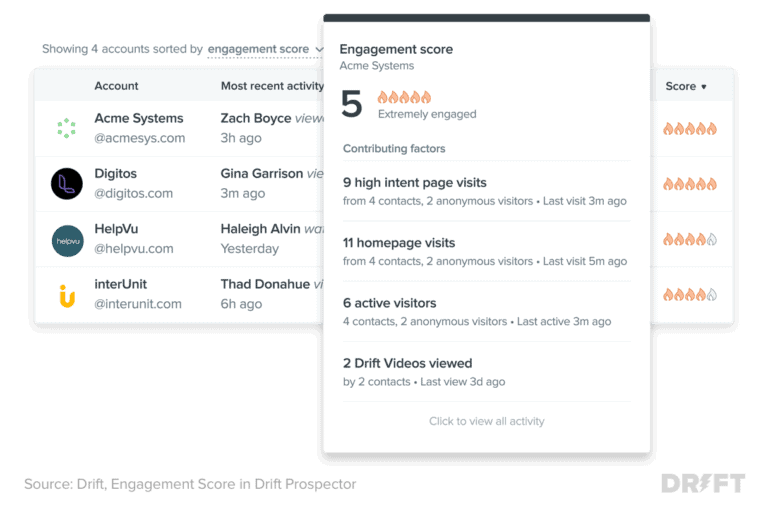

An AI-driven Revenue Acceleration platform can also help your sales team know where to prioritize their nurturing activity and when to engage with active opportunities to shorten their buying process. Putting the right effort in the right place will shorten up your average cycle length.

Metric #6: Win Rate

A CRO will look at win rates to see how well the sales team is doing and whether improved training, product updates, or more data-driven resources could move the revenue needle.

This is an important metric because it helps you pinpoint where issues might lie: does the sales team need to increase their win rate, or do they just need more pipeline in order to hit revenue goals?

To calculate your win ratio, divide the number of won sales opportunities by total sales opportunities.

What supports this metric

If your win rate is high, but you’re still not meeting your revenue goals, then you likely have a pipeline issue. Maybe you’re not driving enough leads, or not showing up for those leads with ads and nurturing materials as well as you should.

Meanwhile, a low win rate could signal a need to refine your customer profile, stop chasing the wrong accounts, and potentially to invest in better sales enablement materials.

Chief revenue officers will certainly grow in both impact and demand, as more companies want a unified focus across every team that affects customer relationships.