For a long time, a financial services firm’s website has been like a digital brochure.

A potential or existing client would land on your website, only to find themselves scouring through pages upon pages of complex information, all on their own. And even if they landed back on your website later on, they would end up in the same loop, forcing them to start their journey over again.

Like many other businesses, the pandemic pushed firms to invest more heavily in digital experiences, especially in the B2B side of their business. But with concerns about security, privacy, and compliance, many firms are still wary of diving too deep into the personalized online experience.

To address those concerns, I spoke with fellow digital advocates, Tara Quehl, Financial Services Product Marketing Director at Demandbase, and Kate Marx, VP and Head of Digital Training & Transformation Program Management at State Street Global Advisors.

Together, we discussed why financial services firms should embrace personalization in their digital experiences, along with tips for how you can get started on creating an impactful and gratifying client journey on your website.

Here’s what you need to know 👇

We originally spoke about this topic on a webinar hosted by B2B Marketing Zone. If you want to watch the full recording, click here. Otherwise, keep reading for all the insights 💡

The Modern B2B Buying Experience Has Gone Mostly Digital

Traditionally, financial services firms have largely relied on in-person meetings to connect with potential clients, educate them on their services, and ultimately make the sale.

But even as firms ease back into those tried-and-true methods, it’s clear that, for clients, digital interactions are now part of the new normal. According to Gartner, by 2025, 80% of B2B sales interactions will occur across digital channels.

This shift means that firms should embrace a balance of in-person and digital interactions to carry the sale. As Kate puts it:

“It’s no longer a requirement [to meet clients out in the field]. It’s not a faux pas, I would say, to not take them out and meet them face to face anymore as virtual interactions are so accepted and familiar as a result of what’s happened.”

At the same time, many of the services and products that financial services firms provide feel like they have become commoditized since the pandemic.

Confusing websites, tedious forms, and long email volleys all fall short of the human experience that clients now expect. And, with the average B2B sales cycle growing to 27 touchpoints, now more than ever, clients need an online experience that helps them get what they need instantly — and with a human touch, when they want it.

That’s why personalization is crucial to truly serve your clients and differentiate your brand from the competition.

Then, What Should a Financial Services Website Look Like?

Personalization can be a tricky topic, especially when there are compliance issues to consider. So, you may be wondering: What should a personalized online experience look like in financial services?

For Tara, the key to personalization is to meet your clients where they are and guide them to the right next step for them. Because personalization isn’t just about the surface-level touches, like greeting clients by name. It’s about paving a path forward for your client based on their specific needs.

“You want to make sure that [clients] are getting where they need to go. So, having a good customer flow, understanding what is their journey, and anticipating those next moves would be really helpful.”

A large part of this is building a strong foundation of data. With accurate data, you can surface content that lines up with your client’s goals, craft more targeted campaigns, and design online journeys for specific client personas (or even a target account).

Here, implementing a tool that collects first-party data can go a long way. Since first-party data is information that site visitors willingly provide to you, it allows you to deliver an experience that is tailored to each individual client. This means that you could identify accounts and greet them with a special message or quickly home in on a site visitor’s intent.

So, Where Should You Start with Your Website?

It goes without saying that you can’t transform your website in a day. But there are steps you can take today that will have an immediate short-term impact as you build out your website for the future.

Our advice: Imagine your ideal online client experience, and work backwards. What are the results you want an improved website or client experience to deliver? Consult team members, partners, and experts to figure out what is possible and what is top-of-mind for your firm before taking that first step. And if you’re still stuck, here are some strategies you can try out 👇

- Fix Your Forms: While many firms rely on online forms to capture interest, clients are often put off by their length and complexity. Try simplifying your forms by asking fewer questions and focusing only on what’s necessary. Better yet, give visitors the chance to skip the form and have a live conversation with you using a tool like Drift Fastlane.

- Put a Face to Your Brand: Your clients are real people, and so are you. So, instead of using stock photos and fake names, feature real employees, clients, and stories in your website copy, visuals, and content. You can also pre-record personalized videos to build connections with a target client, which you can run by your legal and compliance teams in advance.

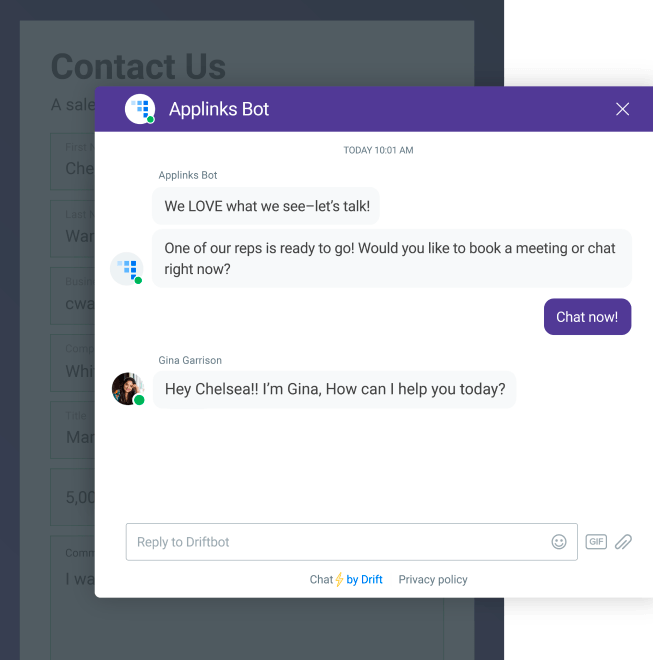

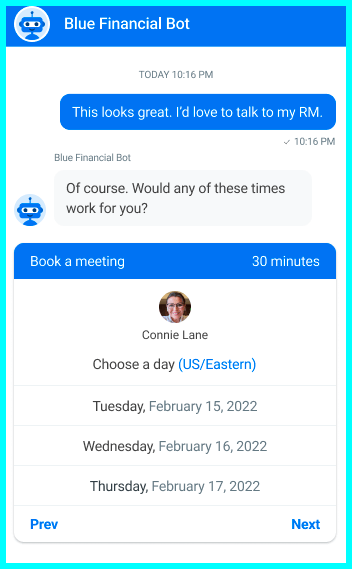

- Give Your Website a Chatbot: There’s no better way to provide your clients with what they need quickly than with an online concierge. Chatbots help scale your conversations with site visitors so that you can automatically pinpoint their intent and serve up the right resources for them. Plus, chatbots gather first-party data so that, when it’s time for a one-to-one conversation, your relationship managers will be able to jump straight into the topics that matter.

- Lean on Automation: On a macro level, marketing automation empowers you to better understand and take action on your client insights. With the right tools and integrations in place, you can deliver personalized client journeys with minimal human intervention — whether that’s surfacing relevant content, automating event registrations, or pinpointing qualified visitors. If you’re not sure where to start, chat with your fellow teams to figure out what would help drive the most efficiency.

Final Thought

With all the guardrails that need to be in place in financial services, it’s unlikely that your website will ever reach the level of customer-centricity that Amazon, Nike, or Netflix have. But there’s nothing wrong with using them as inspiration and relying on your partners to get you closer in a productive and compliant way.

Because as client expectations shift and the digital landscape evolves, your online experience will have to keep pace. The best way to do that? Focus on building the website that your clients want — and eventually, you’ll be able to create a digital experience that your clients won’t forget.