The majority of today’s financial services firms see digital transformation as one of their most important strategic priorities.

According to a recent report by Broadridge, financial services firms are projected to spend 27% of their overall IT budget on digital transformation. That’s because digital transformation is the key to meeting their clients’ current and future needs.

B2B clients have developed consumerized expectations. They choose brands that offer experiences that are personalized, relevant, and guide them along their journey. This change in client expectations — coupled with technological innovation and rising competition — is transforming the banking and financial services industries.

So what’s the secret to getting ahead?

Today’s financial services firms know that creating a differentiated and personalized digital experience is crucial to growing a dedicated client base. With that in mind, this blog breaks down three digital marketing trends — backed by data — that will give your firm a competitive edge in the digital era 👇

1. Don’t Just Digitize. Humanize.

When it comes to digital transformation, there’s a lot of buzz around advancements like cloud computing, automation, and AI. But, at the end of the day, financial services is about humans helping humans. In fact, 89% of B2B buyers said they were more likely to buy from a company that understands their unique goals.

Investing in digital experiences doesn’t mean ignoring the human experience. Instead, the goal of digitizing should be to make your person-to-person interactions even richer.

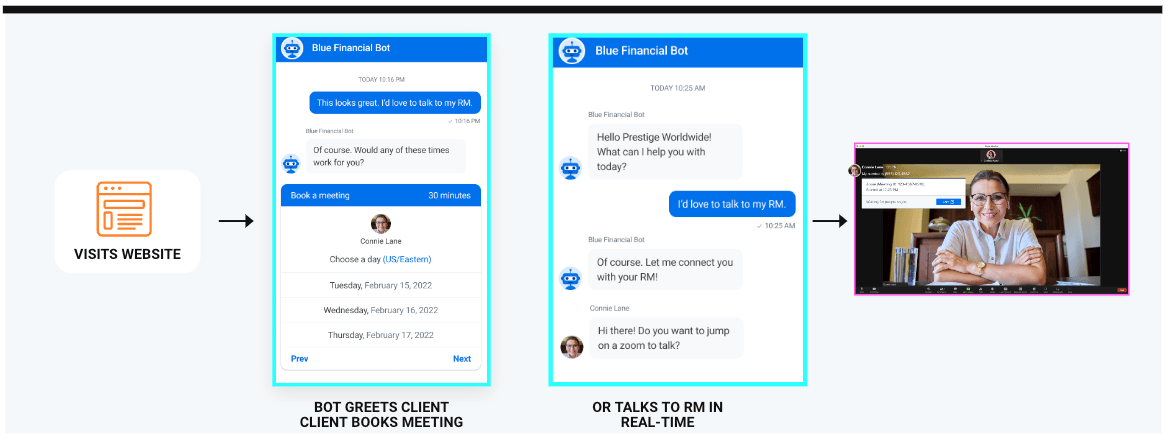

For example, chatbots assist clients who are researching your brand by answering questions instantly and recommending resources that are relevant to their goals. Chatbots are always-on, which means they can provide site visitors with support around the clock — and when it’s time to talk to a relationship manager, they can seamlessly transition to a human-to-human conversation.

Take the case of asset management firm State Street Global Advisors. In 2020, they started piloting Drift’s chatbots to deflect irrelevant traffic, qualify visitors in real time, and have live conversations with leads. With chatbots, SSGA was able to drive more than $65M in allocations in just 18 months.

Not only does this kind of chatbot experience massively boost your responsiveness, but it also shows clients that your RMs are ready and willing to talk. And the results speak for themselves: Our financial services customers have seen an average 28% increase in their web conversion rate with chatbots. Not to mention that conversations are also 5x more likely to convert to leads when a human jumps in.

Altogether, when you combine the responsiveness of digital solutions with personable human interactions, you can strengthen client relationships, foster brand loyalty, and boost conversions — all while ensuring that your clients are getting the best of both digital and person-to-person interactions.

2. Personalize at Every Step of Each Client’s Journey

Our day-to-day lives have become saturated with personalized experiences — and now, that expectation has seeped into our business interactions. In 2021, 52% of B2B companies that provided personalized experiences saw their market share increase. However, that number jumps to 75% for companies that engaged in one-to-one personalization.

What this means is that financial services firms will need to leverage their client data to deliver an experience that is tailored to them. In practice, this could look like delivering targeted messaging, tailoring recommendations, or using first-party cookies to identify who is on your website to deliver a customized, one-to-one experience.

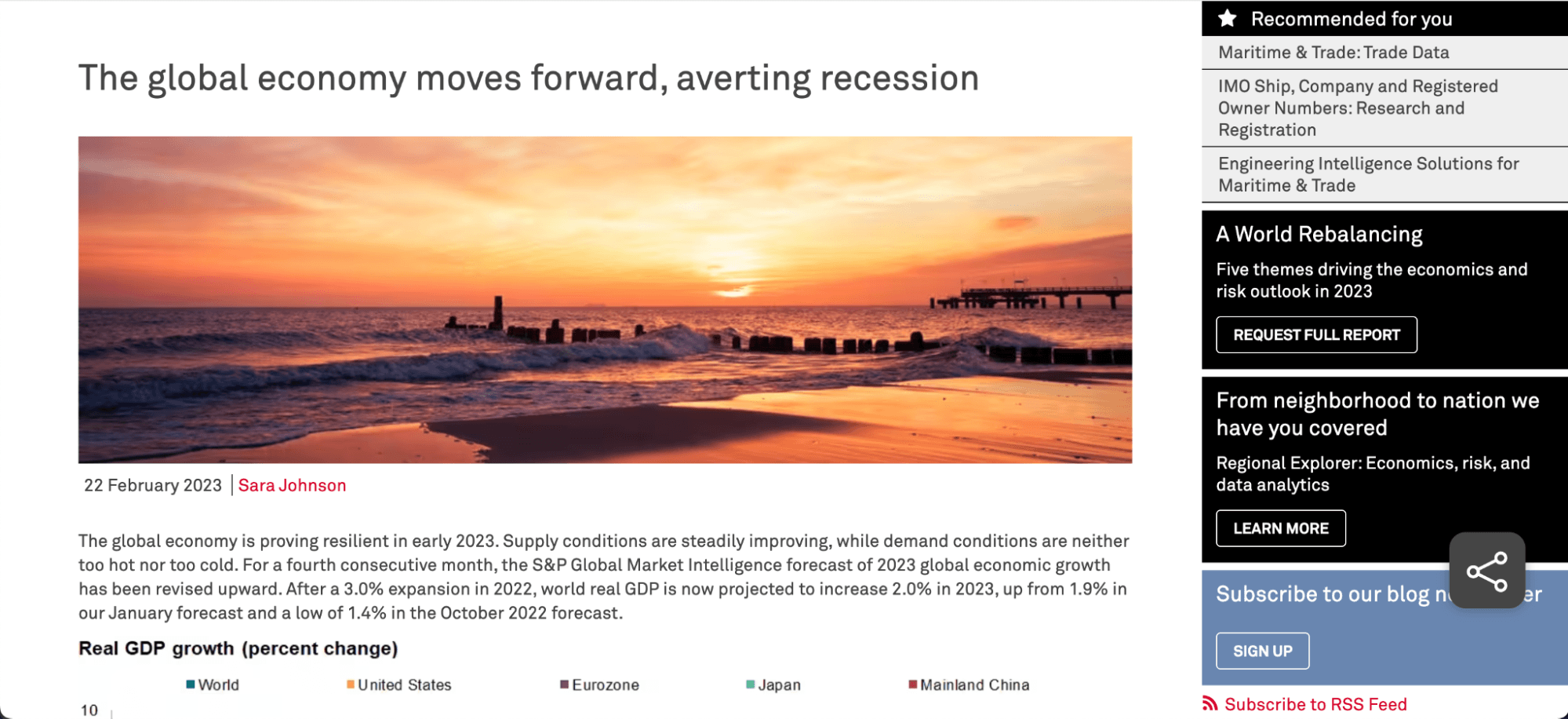

For example, S&P Global Market Intelligence provides market insights for a wide variety of clients across multiple sectors. On their blog pages, they provide a list of recommended content and solutions based on the page you are on, as well as previous site activity.

Personalization isn’t just about serving up the right content, though. It’s also about using the right channels to resonate with clients, based on their preferences. And digital transformation has opened the door to a whole new array of client interactions.

A 2022 Drift survey found that the top three communication channels used by financial services firms were email (89%), social media (51%), and SMS (49%), with some firms also using channels like chatbots, phone calls, and video marketing to connect with their clients online.

While these channels help you better engage clients and reach new audiences, the reality is that these experiences are only effective if they are consistent. In fact, 85% of customers expect consistency across all their interactions with an organization.

So, as financial services firms focus on personalizing each individual client’s experience, maintaining a consistent brand voice and clean, real-time data will prove critical. This means you will need an integrated tech stack that can channel client data to all your teams — that way, if a client clicks on a LinkedIn ad about a new investment promotion, your team will know to bring that up in their next conversation or send a unique chatbot experience when they land on your site.

Looking for more tips on how you can personalize your client experience? Check out our ebook, Personalization That Actually Feels Personal.

3. Use AI to Drive Predictive Analytics

Ever since its initial launch, ChatGPT has been making waves everywhere — and the financial services industry is no exception.

In the past few years, financial services firms have started using artificial intelligence (AI) to automate processes, improve their customer experience, and provide more personalized services. According to an Economist Intelligence Unit report, 86% of financial services executives said they plan on increasing their investments into AI through 2025.

While AI has many different applications, the same report found that the majority of today’s firms (62%) are leveraging their AI for predictive analytics.

For digital marketing, this means using AI to analyze massive sets of data in order to predict clients’ future needs and then proactively sending the right resources to help before being asked. This translates into marketing materials and campaigns that you know will resonate with clients and bring in more opportunities for your business.

New to AI? This ebook will look closely at Conversational AI in particular, in an effort to explain how it works, how it’s helpful, and why it’s time to stop worrying and embrace the robot.

Final Thought

It goes without saying that financial services is a competitive market, and expanding digital initiatives takes time.

But as more people understand and default to digital interactions, clients will naturally gravitate towards those firms that offer the best experiences for them.

The three digital marketing trends we’ve covered today will take you closer to creating that ideal digital experience for your clients — so that not only will you be able to stand out amidst a crowded market, but you will also accelerate time to revenue and build strong client relationships that are sure to last for a long time.

If you want to really hit the ground running, then Drift for financial services offers secure, real-time communication tools that empower you to have the right conversations at the right time. Learn more about how Drift can help accelerate your digital transformation.

Want to keep these trends nearby? Download this executive recap to take with you to your next conversation ⚡️