Picture this: A potential customer visits your website, interested in learning more about your investment options. They’ve actually landed on your website a few times before through a targeted LinkedIn ad, a blog post, and Googling your investment options… but you never knew because they didn’t fill out a form.

👆This is a top-tier opportunity, and the window of time is finite to influence their decisions. The current state leaves investors bouncing from site to site until they find what they’re looking for.

So, while you’ve been marketing to them a lot, you haven’t seen much traction. Until now — when they’ve done all their research and decided that there’s a serious chance they could invest with you. Lucky you.

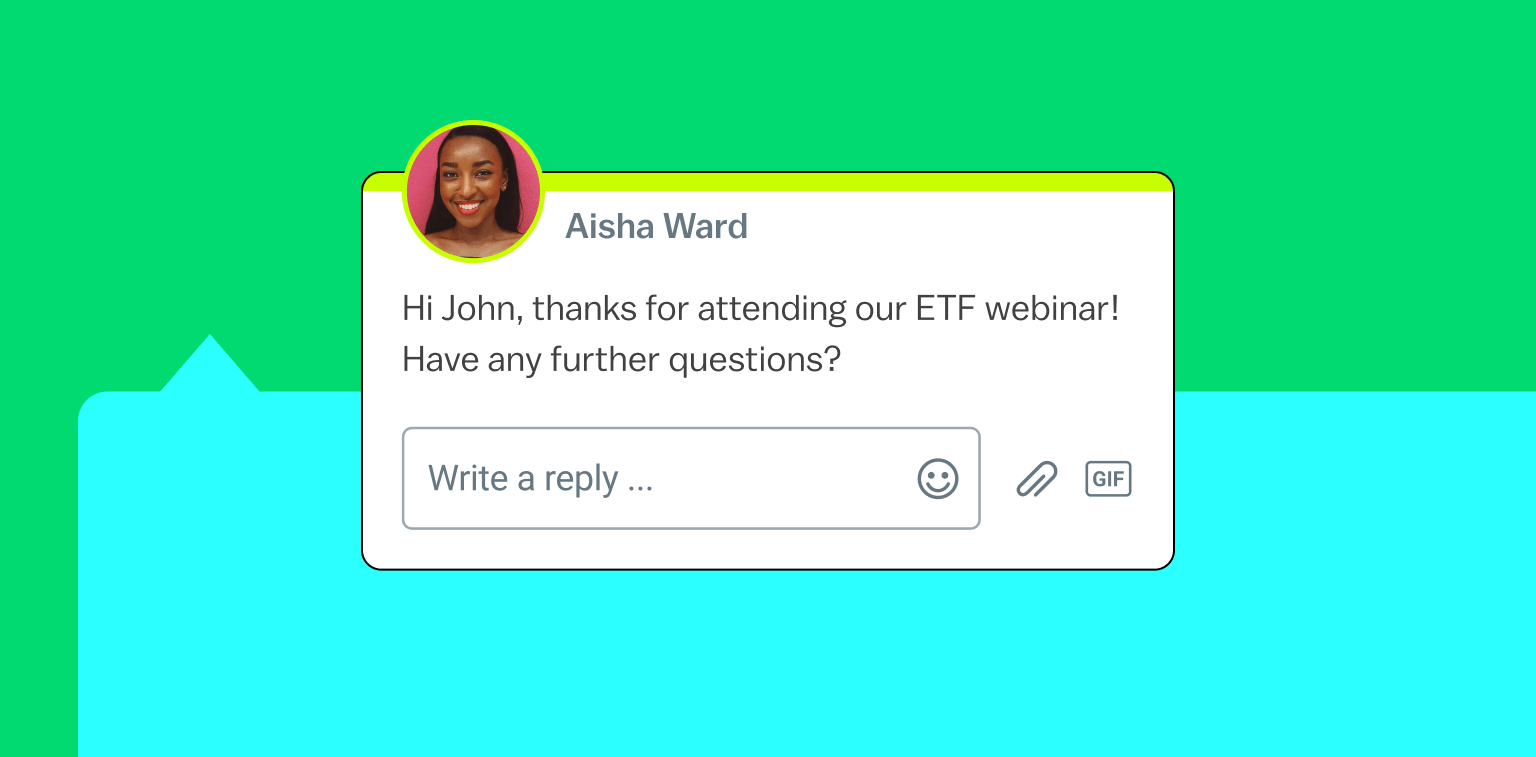

But what if instead when the customer landed on your website the first time, they were greeted with a personalized chat message? The customer clicked to learn more, and your sales team was alerted to jump in for a real-time conversation — quickly influencing the investment decision.

This is the future of Conversational Marketing. Intelligent. Efficient. You convert the customer faster, no luck involved. No more missed opportunities, and no more waiting on the customer’s end.

With Drift, this can be your reality. Drift de-anonymizes your website traffic, showcases customer intent signals for you to act on, and provides real-time insights to help you prioritize your sales efforts — and increase your financial service firms’ website conversion rate by upwards of 28%.

Let’s take a closer look at how we built Drift with your firm’s needs in mind 👇

1. Edge Out Competitors with One-of-a-Kind Customer Experiences

Everyone does targeted advertising. In fact, B2B companies spent $14.3 billion on digital advertising in 2022 alone. But despite all the web traffic generated from that $14.3 billion investment, only 2.3% converted.

The reason? A lack of personalization after the initial ad experience.

When a customer clicks on an ad, there’s a certain intent behind the click. But too often, when when they click, they end up on a generic landing page with one call to action that misses the mark from the initial intent that drove them to the site. All of the personalization that went into garnering the click disappears.

But if the customer were to land on a page that acknowledges where they came from, asks them why they’re there, and gets them the information they were looking for faster, there’s a higher chance that they’ll stick around. That’s why we created Drift Intel. By partnering with data enrichment companies, Drift Intel instantly de-anonymizes your web traffic. This way, you can create a personalized experience for the site visitor without them ever needing to fill out a form. Thanks to features like this, the Drift Conversation Cloud adds, on average, an additional 2,500 qualified leads to firms’ web channels annually.

To really supercharge your conversion rates, consider turning your ad’s landing page into a Conversational Landing Page (CLP). With a CLP, when your customer clicks on an ad, they’re taken to a custom page that acknowledges where they came from and provides relevant content. The customer can also use the chatbot on the page to get questions answered and even book a meeting. And there’s a high chance they might. Our data shows that, with a CLP, conversations are 372% more likely to convert to leads.

By combining Drift Intel with CLPs, you can provide the ultimate personalized experience — proving to customers that you understand who they are, are curious about what they’re looking for, and are ready to help.

2. Engage Target Accounts at Their Moment of Highest Intent

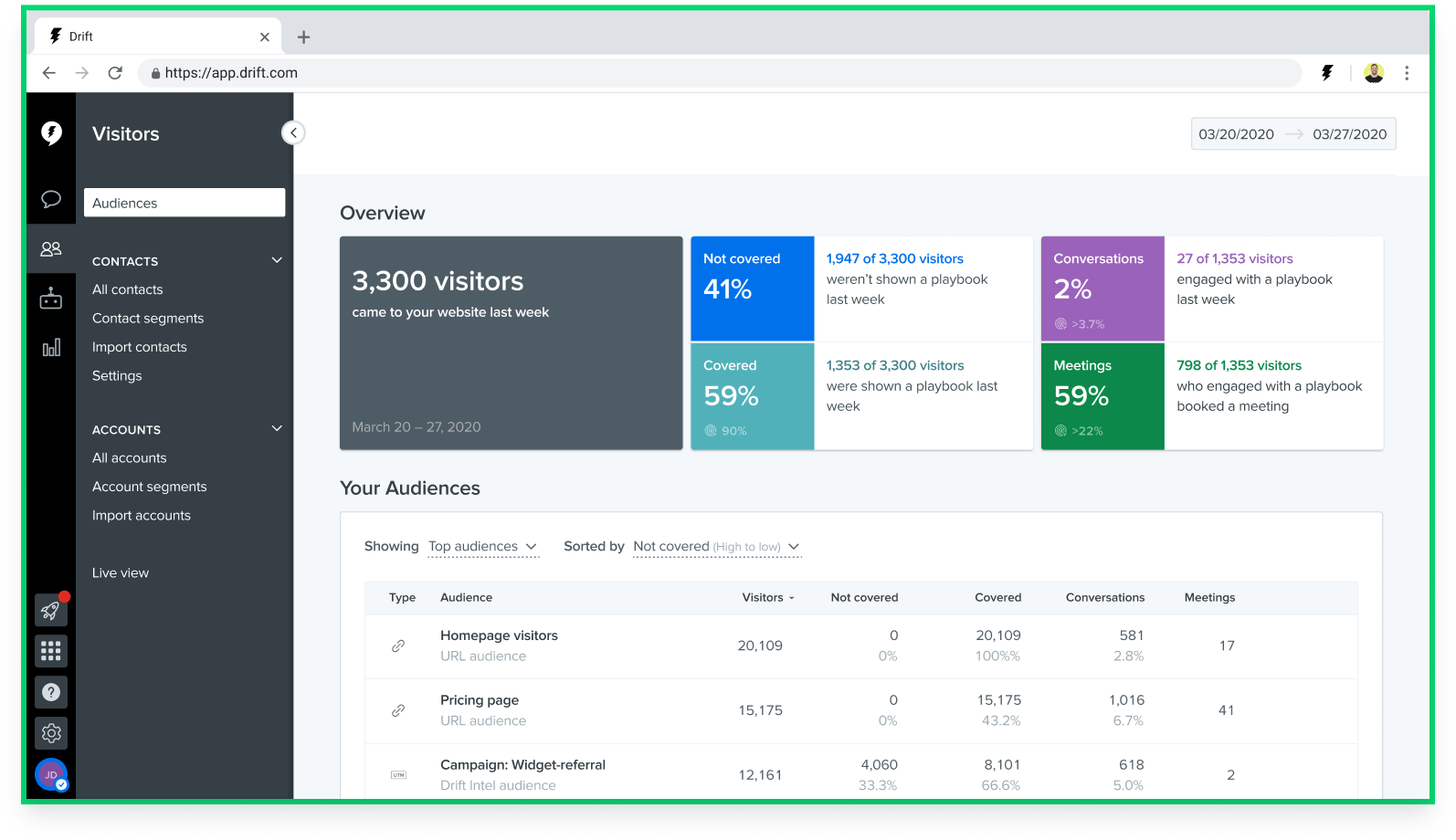

If you have a high volume of traffic coming to your site, it may be difficult to sift through who has the highest propensity to invest in a way that truly moves the needle versus who is best served via automated guidance.

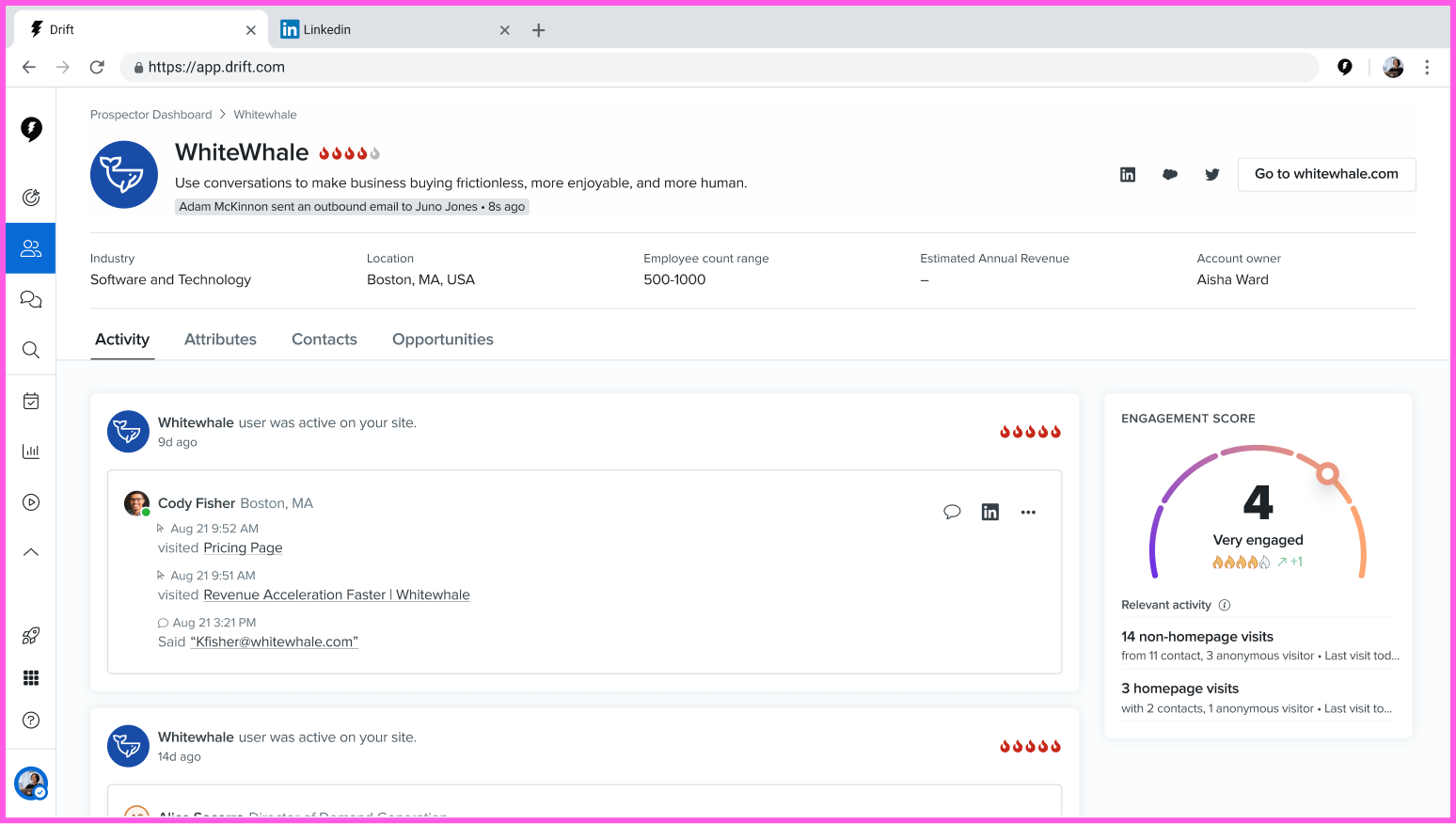

That’s why we built Drift Prospector. Drift Prospector combines investment signals from across your tech stack into one dashboard. There, you can see information like what pages the customer has visited, which emails they’ve opened, the conversations they’ve had, and more.

Knowing what actions your potential customers have already taken will help your sales team prioritize which accounts to focus on first — and it will also help determine what their outreach should look like. Check out how State Street Global Advisors leveraged Drift Prospector to be more proactive in their outreach 👇

Additionally, Drift’s AI-Powered Engagement Score allows you to get even more targeted with your sales strategy. By leveraging the power of AI, Drift will rate accounts based on their level of engagement and alert reps about highly-engaged accounts. You can even customize the different levels of engagement based on your unique business needs.

With all of this information at your fingertips, your marketing and sales teams will be better able to align around their top-priority accounts and work together to decide how to engage them most effectively.

3. More Assets Under Management, Faster

We love net-new business as much as the next company… but that doesn’t mean you can ignore the people who have already committed to you.

We know that customers aren’t something you can sign and forget. You have to make sure that your customers are consistently seeing the value you promised them (and hopefully even more).

Drift Audiences marries all of the data coming in from the various tools you’re using to give you a holistic view of your customers. With this information, your teams can better understand where your customers are on their journey with your service, whether they’re at risk of investing elsewhere, and how you can better serve them so they can achieve their goals.

Supporting your existing customers is also easier with custom routing and real-time notifications. Instead of leaving your marketing team to decipher between individuals, intermediaries, and institutions on your website, Drift can tell you who’s who and automatically notify the right member of the right team to jump into the conversation.

This is especially useful for providing support — your service team can quickly hop into live chat, get a 360-degree view of the problem, and provide a solution. With custom routing, your existing customers can get the answers they need when they need them, and your sales team doesn’t have to worry about getting bogged down with service questions.

Final Thoughts

We know that, in this digital age, cutting through the noise is difficult. That’s why we’ve taken the time to build a solution that will help you connect with customers at every stage of the customer journey — so you can drive more conversions and revenue while reducing costs along the way.

With Drift, financial services customers have seen:

- Higher website lead conversions, especially via gated content and virtual events

- Higher ROI on marketing spend

- Increased productivity and efficiency per salesperson

If this sounds good to you, then get a demo today!